irf

Generate vector autoregression (VAR) model impulse responses

Syntax

Description

The irf function returns the dynamic response, or the impulse response

function (IRF), to a one-standard-deviation shock to each variable in a VAR(p)

model. A fully specified varm model object characterizes the VAR

model.

To estimate or plot the IRF of a dynamic linear model characterized by structural,

autoregression, or moving average coefficient matrices, see armairf.

IRFs trace the effects of an innovation shock to one variable on the response of all

variables in the system. In contrast, the forecast error variance decomposition (FEVD)

provides information about the relative importance of each innovation in affecting all

variables in the system. To estimate the FEVD of a VAR model characterized by a

varm model object, see fevd.

You can supply optional data, such as a presample, as a numeric array, table, or

timetable. However, all specified input data must be the same data type. When the input model

is estimated (returned by estimate), supply the same data type as the data

used to estimate the model. The data type of the outputs matches the data type of the

specified input data.

Response = irf(Mdl)Mdl, characterized by a

fully specified varm model object.

irf shocks variables at time 0, and returns the IRF for

times 0 through 19.

If Mdl is an estimated model (returned by estimate) fit to a numeric matrix of input response data, this syntax

applies.

Response = irf(Mdl,Name=Value)irf(Mdl,NumObs=10,Method="generalized") specifies estimating a

generalized IRF for 10 time points starting at time 0, during which

irf applies the shock.

If Mdl is an estimated model fit to a numeric matrix of input

response data, this syntax applies.

[

returns numeric arrays of lower Response,Lower,Upper] = irf(___)Lower and upper

Upper 95% confidence bounds for confidence intervals on the true

IRF, for each period and variable in the IRF, using any input argument combination in the

previous syntaxes. By default, irf estimates confidence

bounds by conducting Monte Carlo simulation.

If Mdl is an estimated model fit to a numeric matrix of input

response data, this syntax applies.

If Mdl is a custom varm model object (an object not returned by estimate or modified after estimation), irf can

require a sample size for the simulation SampleSize or presample

responses Y0.

Tbl = irf(___)Tbl containing the IRFs and, optionally, corresponding 95%

confidence bounds, of the response variables that compose the VAR(p)

model Mdl. The variables in Tbl correspond to the

variables in the system shocked at time 0. Each variable contains a matrix with columns

corresponding to the IRFs of the variables in the system. (since R2022b)

If you set at least one name-value argument that controls the 95% confidence bounds on

the IRF, Tbl also contains a variable for each of the lower and upper

bounds. For example, Tbl contains confidence bounds when you set the

NumPaths name-value argument.

If Mdl is an estimated model fit to a table or timetable of input

response data, this syntax applies.

Examples

Fit a 4-D VAR(2) model to Danish money and income rate series data in a numeric matrix. Then, estimate and plot the orthogonalized IRF from the estimated model.

Load the Danish money and income data set.

load Data_JDanishFor more details on the data set, enter Description at the command line.

Assuming that the series are stationary, create a varm model object that represents a 4-D VAR(2) model. Specify the variable names.

Mdl = varm(4,2); Mdl.SeriesNames = DataTable.Properties.VariableNames;

Mdl is a varm model object specifying the structure of a 4-D VAR(2) model; it is a template for estimation.

Fit the VAR(2) model to the numeric matrix of time series data Data.

Mdl = estimate(Mdl,Data);

Mdl is a fully specified varm model object representing an estimated 4-D VAR(2) model.

Estimate the orthogonalized IRF from the estimated VAR(2) model.

Response = irf(Mdl);

Response is a 20-by-4-by-4 array representing the IRF of Mdl. Rows correspond to consecutive time points from time 0 to 19, columns correspond to variables receiving a one-standard-deviation innovation shock at time 0, and pages correspond to responses of variables to the variable being shocked. Mdl.SeriesNames specifies the variable order.

Display the IRF of the bond rate (variable 3, IB) when the log of real income (variable 2, Y) is shocked at time 0.

Response(:,2,3)

ans = 20×1

0.0018

0.0048

0.0054

0.0051

0.0040

0.0029

0.0019

0.0011

0.0006

0.0003

0.0001

-0.0000

-0.0001

-0.0001

-0.0001

⋮

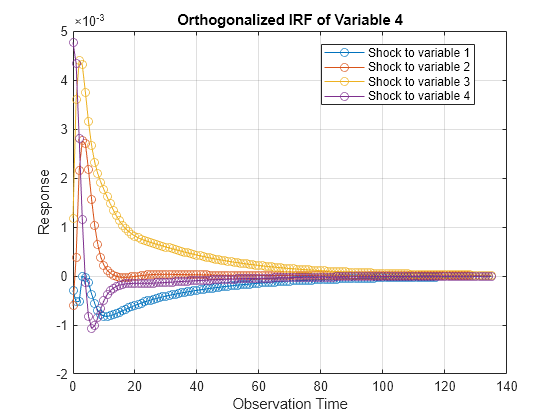

Plot the IRFs of all series on separate plots by passing the estimated AR coefficient matrices and innovations covariance matrix of Mdl to armairf.

armairf(Mdl.AR,[],InnovCov=Mdl.Covariance);

Each plot shows the four IRFs of a variable when all other variables are shocked at time 0. Mdl.SeriesNames specifies the variable order.

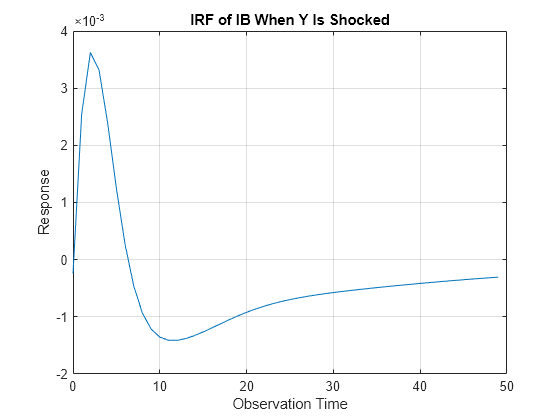

Consider the 4-D VAR(2) model in Specify Data in Numeric Matrix When Plotting IRF. Estimate the generalized IRF of the system for 50 periods.

Load the Danish money and income data set, and then estimate the VAR(2) model.

load Data_JDanish

Mdl = varm(4,2);

Mdl.SeriesNames = DataTable.Properties.VariableNames;

Mdl = estimate(Mdl,DataTable.Series);Estimate the generalized IRF from the estimated VAR(2) model.

Response = irf(Mdl,Method="generalized",NumObs=50);Response is a 50-by-4-by-4 array representing the generalized IRF of Mdl.

Plot the generalized IRF of the bond rate when real income is shocked at time 0.

figure; plot(0:49,Response(:,2,3)) title("IRF of IB When Y Is Shocked") xlabel("Observation Time") ylabel("Response") grid on

The bond rate fades slowly when real income is shocked at time 0.

Since R2022b

Fit a 4-D VAR(2) model to Danish money and income rate series data in a numeric matrix. Then, estimate and plot the orthogonalized IRF from the estimated model.

Load the Danish money and income data set.

load Data_JDanishThe data set includes four time series in the timetable DataTimeTable. For more details on the data set, enter Description at the command line.

Assuming that the series are stationary, create a varm model object that represents a 4-D VAR(2) model. Specify the variable names.

Mdl = varm(4,2); Mdl.SeriesNames = DataTimeTable.Properties.VariableNames;

Mdl is a varm model object specifying the structure of a 4-D VAR(2) model; it is a template for estimation.

Fit the VAR(2) model to the data set.

EstMdl = estimate(Mdl,DataTimeTable);

Mdl is a fully specified varm model object representing an estimated 4-D VAR(2) model.

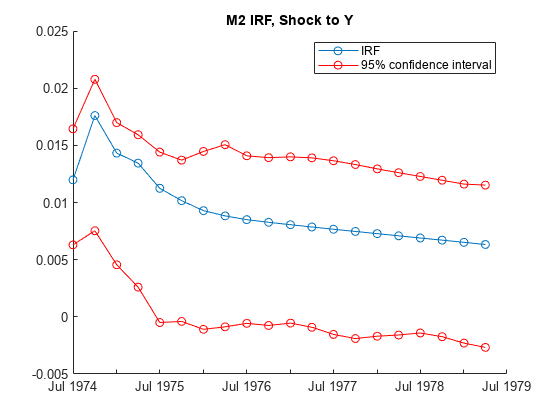

Estimate the orthogonalized IRF and corresponding 95% confidence intervals from the estimated VAR(2) model. To return confidence intervals, you must set a name-value argument that controls confidence intervals, for example, Confidence. Set Confidence to 0.95.

rng(1); % For reproducibility

Tbl = irf(EstMdl,Confidence=0.95);

size(Tbl)ans = 1×2

20 12

Tbl

Tbl=20×12 timetable

Time M2_IRF Y_IRF IB_IRF ID_IRF M2_IRF_LowerBound Y_IRF_LowerBound IB_IRF_LowerBound ID_IRF_LowerBound M2_IRF_UpperBound Y_IRF_UpperBound IB_IRF_UpperBound ID_IRF_UpperBound

___________ _____________________________________________________ _______________________________________________________ ___________________________________________________ _______________________________________________________ _______________________________________________________ _______________________________________________________ ______________________________________________________ _______________________________________________________ _____________________________________________________ ___________________________________________________ ____________________________________________________ ___________________________________________________

01-Jul-1974 0.025385 0.011979 -0.0030299 -0.00029592 0 0.017334 0.0017985 -0.00060941 0 0 0.0072384 0.0011766 0 0 0 0.0047648 0.017729 0.0062931 -0.0046236 -0.0012223 0 0.012192 -0.00017736 -0.0016259 0 0 0.0046542 -0.00050518 0 0 0 0.00322 0.02713 0.016442 -0.00074788 0.0010392 0 0.019303 0.0037597 0.00088073 0 0 0.0080468 0.002298 0 0 0 0.0049936

01-Oct-1974 0.019597 0.017604 -0.0024059 -0.00052605 0.0022668 0.014588 0.0047558 0.00037877 -0.011013 -0.0010791 0.0096387 0.0036033 -0.0014511 -0.0044686 -1.6666e-05 0.0043446 0.0088617 0.0075327 -0.0054155 -0.0024484 -0.0045762 0.0055602 0.00085487 -0.0014949 -0.015821 -0.0059937 0.0044639 0.00097209 -0.0072913 -0.0092174 -0.0021639 0.001595 0.024652 0.020779 0.00056005 0.0014407 0.0069932 0.017056 0.0070093 0.0021859 -0.0048396 0.0046483 0.010957 0.0051531 0.0043279 0.00045888 0.0017342 0.0050611

01-Jan-1975 0.023011 0.01432 -0.0014045 -0.00051972 -0.0043703 0.011341 0.005376 0.0021556 -0.019326 -0.0046725 0.010182 0.004395 0.0017534 -0.0060605 -0.0011601 0.002806 0.011414 0.0045521 -0.004882 -0.0024604 -0.01291 -0.00094466 -0.00017957 -0.00068506 -0.021662 -0.011 0.0035604 0.0011887 -0.0069887 -0.01257 -0.0045524 -0.00041328 0.029914 0.016987 0.0018906 0.0011012 0.0051311 0.013943 0.0080383 0.0041762 -0.0068581 0.003094 0.012053 0.0057324 0.0082731 0.0013124 0.0025533 0.0042406

01-Apr-1975 0.019864 0.01344 -0.0014933 -4.4254e-06 -0.0078183 0.0062247 0.0050662 0.0027626 -0.025548 -0.0070059 0.009493 0.0043074 0.0045597 -0.004589 -0.002223 0.0011591 0.0063539 0.0025976 -0.0054684 -0.0021938 -0.017355 -0.0064979 -0.00123 0.00010743 -0.029292 -0.013974 0.0015562 0.00077995 -0.0081444 -0.011287 -0.0062556 -0.0022002 0.028924 0.015926 0.0014925 0.0012851 0.0059606 0.011209 0.0080886 0.0047651 -0.0063978 0.0028959 0.012097 0.0057966 0.014418 0.0038715 0.0033635 0.0023838

01-Jul-1975 0.019419 0.011244 -0.0015969 -3.4305e-05 -0.010187 0.0028147 0.0039998 0.0026985 -0.029124 -0.0084906 0.0084798 0.0037481 0.0077423 -0.0025063 -0.0026634 -0.00013404 0.005327 -0.00049621 -0.0054593 -0.0021455 -0.022716 -0.0081187 -0.0028733 -0.00042378 -0.034992 -0.015799 0.00056474 0.00020164 -0.0078458 -0.010846 -0.0068023 -0.0035519 0.029407 0.014405 0.001692 0.0015767 0.0087664 0.010134 0.0075162 0.0043343 -0.0057691 0.0018746 0.012047 0.0055231 0.020043 0.0064893 0.0029097 0.001343

01-Oct-1975 0.018532 0.01016 -0.0019436 -0.00013964 -0.010448 0.00049217 0.0028587 0.0021692 -0.031107 -0.0092773 0.0074784 0.0031474 0.0097242 -0.00029442 -0.0026358 -0.00082626 0.001818 -0.0004023 -0.0058779 -0.0022755 -0.023734 -0.0077482 -0.0042795 -0.00098779 -0.038594 -0.016547 -0.00011469 -0.00064435 -0.0095859 -0.0070065 -0.0059945 -0.0034737 0.030136 0.013705 0.0016763 0.0017479 0.011566 0.0082498 0.0057995 0.0033017 -0.0044473 0.0013279 0.011642 0.0050999 0.022978 0.0090112 0.0027824 0.0014644

01-Jan-1976 0.018426 0.0092868 -0.0022099 -0.00036763 -0.0097658 -0.00071481 0.0018519 0.0015618 -0.032019 -0.0098054 0.0066319 0.002661 0.010735 0.0013489 -0.0022958 -0.001066 0.00094487 -0.0010919 -0.0057706 -0.0026426 -0.023367 -0.0091729 -0.0049467 -0.0014946 -0.042002 -0.016681 -0.00084973 -0.0010919 -0.010268 -0.0059067 -0.0046107 -0.0030697 0.030831 0.014467 0.0020979 0.0014645 0.013995 0.0070356 0.0042604 0.0028084 -0.0042527 0.0021613 0.010919 0.0047273 0.024747 0.010363 0.0021819 0.00073538

01-Apr-1976 0.018347 0.0088274 -0.002408 -0.00055954 -0.0085284 -0.0013241 0.0011035 0.001029 -0.032301 -0.010245 0.0059331 0.0023208 0.010834 0.0024299 -0.0018575 -0.0010181 0.00088792 -0.00087384 -0.0057043 -0.0027239 -0.022321 -0.0095626 -0.0046415 -0.0016955 -0.044772 -0.015403 -0.0014757 -0.00074988 -0.010505 -0.0057904 -0.0042961 -0.0025666 0.030874 0.015059 0.0021942 0.0012385 0.01511 0.0075202 0.0041588 0.0022807 -0.0018926 0.0020667 0.0099711 0.0041106 0.027227 0.010447 0.0026554 0.0011517

01-Jul-1976 0.018349 0.0085007 -0.0025003 -0.00070381 -0.0072023 -0.0015783 0.00059083 0.00064004 -0.032139 -0.010662 0.0053454 0.0020863 0.010389 0.0030152 -0.0014396 -0.00084984 0.00081535 -0.00056917 -0.0054989 -0.0027904 -0.020095 -0.0090132 -0.003905 -0.0019258 -0.046259 -0.016859 -0.0018945 -0.0010315 -0.0088981 -0.0047543 -0.0042238 -0.0017878 0.030856 0.014085 0.0023174 0.0013691 0.017564 0.0079639 0.0040872 0.0017655 -0.001588 0.0020803 0.0088559 0.0036667 0.02646 0.010048 0.0026267 0.0012534

01-Oct-1976 0.018261 0.0082681 -0.0025175 -0.00078515 -0.0059528 -0.0016715 0.000265 0.00038128 -0.031642 -0.01103 0.0048331 0.0019104 0.0096565 0.0032746 -0.0011032 -0.00066034 -0.0011251 -0.00075733 -0.0050727 -0.0026529 -0.019957 -0.0091831 -0.0037003 -0.0015265 -0.046571 -0.018406 -0.0023099 -0.0010146 -0.0087836 -0.0043276 -0.0035229 -0.0015206 0.031925 0.013921 0.0023499 0.0013534 0.017285 0.0080779 0.0037871 0.0016071 0.00034958 0.0018116 0.0082019 0.0031525 0.025188 0.0098717 0.0023763 0.001372

01-Jan-1977 0.018088 0.0080578 -0.0024803 -0.00082067 -0.004866 -0.0016783 6.7351e-05 0.00021975 -0.030874 -0.011308 0.0043776 0.0017587 0.0088385 0.0033353 -0.00085828 -0.00049952 -0.0023654 -0.00054861 -0.0046959 -0.0023017 -0.018881 -0.0083688 -0.0036323 -0.0013151 -0.045822 -0.019143 -0.0022457 -0.00076165 -0.0096651 -0.0046474 -0.0033535 -0.001605 0.031832 0.013992 0.0023109 0.0011487 0.01618 0.0079136 0.0033058 0.0015065 0.0014169 0.0019553 0.0074233 0.0026903 0.023693 0.0092439 0.0022507 0.0010427

01-Apr-1977 0.01782 0.0078585 -0.0024126 -0.00082488 -0.0039472 -0.0016348 -4.6051e-05 0.00012029 -0.029898 -0.011467 0.0039728 0.0016154 0.0080434 0.0032901 -0.00069265 -0.00038034 -0.0041445 -0.0009108 -0.0046233 -0.0021475 -0.017842 -0.0074943 -0.0036166 -0.0012714 -0.044148 -0.019166 -0.0023327 -0.00078836 -0.010263 -0.0046773 -0.0028019 -0.001797 0.030983 0.013903 0.0022172 0.001152 0.014886 0.007478 0.0027978 0.0013601 0.0017628 0.0019984 0.0059992 0.0024748 0.023083 0.0093155 0.0021594 0.00090656

01-Jul-1977 0.01748 0.0076612 -0.0023288 -0.00081178 -0.0031853 -0.0015527 -0.00010551 5.8177e-05 -0.028778 -0.011497 0.0036184 0.001477 0.007324 0.0031905 -0.00058632 -0.00029882 -0.0055294 -0.00154 -0.0045625 -0.0019225 -0.017729 -0.00744 -0.0034336 -0.0012351 -0.041703 -0.018635 -0.0029266 -0.00097794 -0.010567 -0.004571 -0.0030526 -0.00144 0.029897 0.013651 0.002083 0.0011265 0.015725 0.0067952 0.0028631 0.0012628 0.0032766 0.0021382 0.0054534 0.00231 0.021 0.0091161 0.00197 0.000865

01-Oct-1977 0.017084 0.0074669 -0.0022386 -0.00078982 -0.0025611 -0.0014412 -0.00012965 1.837e-05 -0.027577 -0.01141 0.003315 0.0013467 0.0066953 0.0030638 -0.00052096 -0.00024515 -0.0059883 -0.0019006 -0.0045009 -0.0017518 -0.016735 -0.0070905 -0.0030476 -0.0012138 -0.03866 -0.017655 -0.0023904 -0.0010579 -0.010714 -0.0044868 -0.0030057 -0.0010935 0.028693 0.01332 0.0015194 0.0010569 0.016655 0.0061735 0.0029008 0.0010539 0.0049304 0.0023071 0.0052074 0.0022951 0.019005 0.008691 0.0018979 0.00088102

01-Jan-1978 0.016649 0.007275 -0.0021468 -0.00076393 -0.0020585 -0.0013098 -0.00013023 -6.9227e-06 -0.02635 -0.011223 0.0030608 0.0012284 0.006156 0.0029232 -0.00048251 -0.00021015 -0.0067654 -0.0016931 -0.0044291 -0.0016366 -0.016779 -0.0072429 -0.0028373 -0.0011991 -0.035195 -0.016242 -0.0025182 -0.0010499 -0.010659 -0.0043064 -0.002775 -0.0010409 0.028206 0.01294 0.0015156 0.00095142 0.016305 0.0058332 0.0026818 0.00094436 0.0054449 0.0022641 0.0053236 0.0021337 0.018369 0.0079906 0.0017187 0.00082592

01-Apr-1978 0.016187 0.0070851 -0.0020565 -0.00073641 -0.0016627 -0.0011692 -0.00011514 -2.1687e-05 -0.025141 -0.010963 0.0028515 0.001125 0.0056974 0.0027764 -0.00046133 -0.00018714 -0.0053812 -0.0015885 -0.0043428 -0.0016435 -0.016571 -0.007324 -0.0025033 -0.0011496 -0.033556 -0.015142 -0.0025535 -0.0010552 -0.010407 -0.0040787 -0.0025947 -0.0011176 0.027675 0.012605 0.0015485 0.00082164 0.015764 0.0056146 0.0024931 0.0010281 0.0054922 0.0019958 0.0054463 0.0021499 0.019244 0.0078422 0.00157 0.00071951

⋮

Tbl is a timetable with 20 rows, representing the periods in the IRF, and 12 variables. Each variable is a 20-by-4 matrix of the IRF or confidence bound associated with a variable in the model EstMdl. For example, Tbl.M2_IRF(:,2) is the IRF of Mdl.SeriesNames(2), which is the variable Y, resulting from a one-standard-deviation shock on 01-Jul-1974 (period 0) to M2. [Tbl.M2_IRF_LowerBound(:,2),Tbl.M2_IRF_UpperBound(:,2)] are the corresponding 95% confidence intervals.

Plot the IRF of Y and its 95% confidence interval resulting from a one-standard-deviation shock on 01-Jul-1974 to M2.

idxM2 = startsWith(Tbl.Properties.VariableNames,"M2"); M2IRF = Tbl(:,idxM2); shockIdx = 2; figure hold on plot(M2IRF.Time,M2IRF.M2_IRF(:,shockIdx),"-o") plot(M2IRF.Time,[M2IRF.M2_IRF_LowerBound(:,shockIdx) ... M2IRF.M2_IRF_UpperBound(:,shockIdx)],"-o",Color="r") legend("IRF","95% confidence interval") title("Y IRF, Shock to M2") hold off

Consider the 4-D VAR(2) model in Specify Data in Numeric Matrix When Plotting IRF. Estimate and plot its orthogonalized IRF and 95% Monte Carlo confidence intervals on the true IRF.

Load the Danish money and income data set, then estimate the VAR(2) model.

load Data_JDanish

Mdl = varm(4,2);

Mdl.SeriesNames = DataTable.Properties.VariableNames;

Mdl = estimate(Mdl,DataTable.Series);Estimate the IRF and corresponding 95% Monte Carlo confidence intervals from the estimated VAR(2) model.

rng(1); % For reproducibility

[Response,Lower,Upper] = irf(Mdl);Response, Lower, and Upper are 20-by-4-by-4 arrays representing the orthogonalized IRF of Mdl and corresponding lower and upper bounds of the confidence intervals. For all arrays, rows correspond to consecutive time points from time 0 to 19, columns correspond to variables receiving a one-standard-deviation innovation shock at time 0, and pages correspond to responses of variables to the variable being shocked. Mdl.SeriesNames specifies the variable order.

Plot the orthogonalized IRF with its confidence bounds of the bond rate when real income is shocked at time 0.

irfshock2resp3 = Response(:,2,3); IRFCIShock2Resp3 = [Lower(:,2,3) Upper(:,2,3)]; figure; h1 = plot(0:19,irfshock2resp3); hold on h2 = plot(0:19,IRFCIShock2Resp3,"r--"); legend([h1 h2(1)],["IRF" "95% Confidence Interval"]) xlabel("Time Index"); ylabel("Response"); title("IRF of IB When Y Is Shocked"); grid on hold off

The effect of the impulse to real income on the bond rate fades after 10 periods.

Consider the 4-D VAR(2) model in Specify Data in Numeric Matrix When Plotting IRF. Estimate and plot its orthogonalized IRF and 90% bootstrap confidence intervals on the true IRF.

Load the Danish money and income data set, and then estimate the VAR(2) model. Return the residuals from model estimation.

load Data_JDanish Mdl = varm(4,2); Mdl.SeriesNames = DataTable.Properties.VariableNames; [Mdl,~,~,Res] = estimate(Mdl,DataTable.Series); T = size(DataTable,1) % Total sample size

T = 55

n = size(Res,1) % Effective sample sizen = 53

Res is a 53-by-4 array of residuals. Columns correspond to the variables in Mdl.SeriesNames. The estimate function requires Mdl.P = 2 observations to initialize a VAR(2) model for estimation. Because presample data (Y0) is unspecified, estimate takes the first two observations in the specified response data to initialize the model. Therefore, the resulting effective sample size is T – Mdl.P = 53, and rows of Res correspond to the observation indices 3 through T.

Estimate the orthogonalized IRF and corresponding 90% bootstrap confidence intervals from the estimated VAR(2) model. Draw 500 paths of length n from the series of residuals.

rng(1); % For reproducibility

[Response,Lower,Upper] = irf(Mdl,E=Res,NumPaths=500,Confidence=0.9);Plot the orthogonalized IRF with its confidence bounds of the bond rate when real income is shocked at time 0.

irfshock2resp3 = Response(:,2,3); IRFCIShock2Resp3 = [Lower(:,2,3) Upper(:,2,3)]; figure; h1 = plot(0:19,irfshock2resp3); hold on h2 = plot(0:19,IRFCIShock2Resp3,"r--"); legend([h1 h2(1)],["IRF" "90% confidence interval"]) xlabel("Time Index") ylabel("Response") title("IRF of IB When Y Is Shocked"); grid on hold off

The effect of the impulse to real income on the bond rate fades after 10 periods.

Input Arguments

VAR model, specified as a varm model object created by varm or estimate. Mdl must be fully specified.

If Mdl is an estimated model (returned by estimate) , you must supply any optional data using the same data type as the input response data, to which the model is fit.

If Mdl is a custom varm model object (an object not returned by estimate or modified after estimation), irf can require a sample size for the simulation SampleSize or presample responses Y0.

Name-Value Arguments

Specify optional pairs of arguments as

Name1=Value1,...,NameN=ValueN, where Name is

the argument name and Value is the corresponding value.

Name-value arguments must appear after other arguments, but the order of the

pairs does not matter.

Before R2021a, use commas to separate each name and value, and enclose

Name in quotes.

Example: irf(Mdl,NumObs=10,Method="generalized") specifies estimating

a generalized IRF for 10 time points starting at time 0, during which

irf applies the shock.

Options for All IRFs

Number of periods for which irf computes

the IRF, specified as a positive integer.

NumObs specifies the number of

observations to include in the IRF (the number of rows in

Response or

Tbl).

Example: NumObs=10 specifies the inclusion of 10

time points in the IRF starting at time 0, during which

irf applies the shock,

and ending at period 9.

Data Types: double

IRF computation method, specified as a value in this table.

| Value | Description |

|---|---|

"orthogonalized" | Compute impulse responses using orthogonalized,

one-standard-deviation innovation shocks.

irf uses the Cholesky factorization of

Mdl.Covariance for orthogonalization. |

"generalized" | Compute impulse responses using one-standard-deviation innovation shocks. |

Example: Method="generalized"

Data Types: string | char

Options for Confidence Bound Estimation

Number of sample paths (trials) to generate, specified as a positive integer.

Example: NumPaths=1000 generates 1000 sample

paths from which the software derives the confidence bounds.

Data Types: double

Number of observations for the Monte Carlo simulation or bootstrap per sample path, specified as a positive integer.

Example: If you specify SampleSize=100 and do not specify the

E name-value argument, the software estimates confidence bounds

from NumPaths random paths of length 100 from

Mdl.

Example: If you specify SampleSize=100,E=Res, the software

resamples, with replacement, 100 observations (rows) from

Res to form a sample path of innovations to filter through

Mdl. The software forms NumPaths random

sample paths from which it derives confidence bounds.

Data Types: double

Presample response data that provides initial values for model estimation during the

simulation, specified as a numpreobs-by-numseries

numeric matrix. Use Y0 only in the following situations:

numpreobs is the number of presample observations.

numseries is Mdl.NumSeries, the dimensionality of the

input model.

Each row is a presample observation, and measurements in each row occur simultaneously.

The last row contains the latest presample observation. numpreobs is the

number of specified presample responses and it must be at least Mdl.P. If

you supply more rows than necessary, irf uses the latest

Mdl.P observations only.

numseries is the dimensionality of the input VAR model

Mdl.NumSeries. Columns must correspond to the response variables in

Mdl.SeriesNames.

The following situations determine the default or whether presample response data is required.

Data Types: double

Since R2022b

Presample data that provides initial values for the model Mdl,

specified as a table or timetable with numprevars variables and

numpreobs rows. Use Presample only in the

following situations:

Each row is a presample observation, and measurements in each row occur

simultaneously. numpreobs must be at least Mdl.P.

If you supply more rows than necessary, irf uses the latest

Mdl.P observations only.

Each variable is a numpreobs numeric vector representing one path.

To control presample variable selection, see the optional

PresampleResponseVariables name-value argument.

If Presample is a timetable, all the following conditions must be true:

Presamplemust represent a sample with a regular datetime time step (seeisregular).The datetime vector of sample timestamps

Presample.Timemust be ascending or descending.

If Presample is a table, the last row contains the latest

presample observation.

The following situations determine the default or whether presample response data is required.

If

Mdlis an unmodified estimated model,irfsetsPresampleto the presample response data used for estimation by default (see thePresamplename-value argument ofestimate).If

Mdlis a custom model (for example, you modify a model after estimation by using dot notation) and you return confidence bounds in the table or timetableTbl, you must specifyPresample.

Since R2022b

Variables to select from Presample to use for presample data, specified

as one of the following data types:

String vector or cell vector of character vectors containing

numseriesvariable names inPresample.Properties.VariableNamesA length

numseriesvector of unique indices (integers) of variables to select fromPresample.Properties.VariableNamesA length

numprevarslogical vector, wherePresampleResponseVariables(selects variablej) = truejPresample.Properties.VariableNames, andsum(PresampleResponseVariables)isnumseries

PresampleResponseVariables applies only when you specify

Presample.

The selected variables must be numeric vectors and cannot contain missing values

(NaN).

PresampleResponseNames does not need to contain the same names as in

Mdl.SeriesNames; irf uses the data in

selected variable PresampleResponseVariables(

as a presample for j)Mdl.SeriesNames(.j)

If the number of variables in Presample matches

Mdl.NumSeries, the default specifies all variables in

Presample. If the number of variables in Presample

exceeds Mdl.NumSeries, the default matches variables in

Presample to names in Mdl.SeriesNames.

Example: PresampleResponseVariables=["GDP" "CPI"]

Example: PresampleResponseVariables=[true false true false] or

PresampleResponseVariable=[1 3] selects the first and third table

variables for presample data.

Data Types: double | logical | char | cell | string

Predictor data xt for

estimating the model regression component during the simulation, specified as a numeric matrix

containing numpreds columns. Use X only in the following situations:

numpreds is the number of predictor variables

(size(Mdl.Beta,2)).

Each row corresponds to an observation, and measurements in each row

occur simultaneously. The last row contains the latest

observation. X must have at least

SampleSize rows. If you supply

more rows than necessary, irf uses

only the latest observations. irf

does not use the regression component in the presample

period.

Columns correspond to individual predictor variables. All predictor variables are present in the regression component of each response equation.

To maintain model consistency when irf

estimates the confidence bounds, specify predictor data when Mdl has a

regression component. If Mdl is an estimated model, specify the predictor

data used during model estimation (see the X name-value argument of estimate).

By default, irf excludes the regression

component from confidence bound estimation, regardless of its

presence in Mdl.

Data Types: double

Series of residuals from which to draw bootstrap samples, specified as a

numperiods-by-numseries numeric matrix.

irf assumes that E is free of serial

correlation. Use E only in the following situations:

Each column is the residual series corresponding to the response series names in

Mdl.SeriesNames.

Each row corresponds to a period in the FEVD and the corresponding confidence bounds.

If Mdl is an estimated varm model object (an object returned by estimate), you can specify E as the inferred

residuals from estimation (see the E output argument of

estimate or infer).

By default, irf derives confidence bounds by conducting a

Monte Carlo simulation.

Data Types: double

Since R2022b

Time series data containing numvars variables, including

numseries variables of residuals

et to bootstrap or

numpreds predictor variables

xt for the model regression component,

specified as a table or timetable. Use InSample only in the

following situations:

Each variable is a single path of observations, which irf

applies to all NumPaths sample paths. If you specify

Presample, you must specify which variables are residuals and

predictors. See the ResidualVariables and

PredictorVariables name-value arguments.

Each row is an observation, and measurements in each row occur simultaneously.

InSample must have at least SampleSize

rows. If you supply more rows than necessary, irf uses only

the latest observations.

If InSample is a timetable, the following conditions apply:

InSamplemust represent a sample with a regular datetime time step (seeisregular).The datetime vector

InSample.Timemust be ascending or descending.Presamplemust immediately precedeInSample, with respect to the sampling frequency.

If InSample is a table, the last row contains the latest

observation.

By default, irf derives confidence bounds by conducting a

Monte Carlo simulation and does not use the regression component, regardless of its

presence in Mdl.

Since R2022b

Variables to select from InSample to treat as residuals for

bootstrapping, specified as one of the following data types:

String vector or cell vector of character vectors containing

numseriesvariable names inInSample.Properties.VariableNamesA length

numseriesvector of unique indices (integers) of variables to select fromInSample.Properties.VariableNamesA length

numvarslogical vector, whereResidualVariables(selects variablej) = truejInSample.Properties.VariableNames, andsum(ResidualVariables)isnumseries

Regardless, selected residual variable

jMdl.SeriesNames(.j)

The selected variables must be numeric vectors and cannot contain missing values

(NaN).

By default, irf derives confidence bounds by conducting a

Monte Carlo simulation.

Example: ResidualVariables=["GDP_Residuals"

"CPI_Residuals"]

Example: ResidualVariables=[true false true false] or

ResidualVariable=[1 3] selects the first and third table variables as the

disturbance variables.

Data Types: double | logical | char | cell | string

Since R2022b

Variables to select from InSample to treat as exogenous predictor

variables xt, specified as one of the following data types:

String vector or cell vector of character vectors containing

numpredsvariable names inInSample.Properties.VariableNamesA length

numpredsvector of unique indices (integers) of variables to select fromInSample.Properties.VariableNamesA length

numvarslogical vector, wherePredictorVariables(selects variablej) = truejInSample.Properties.VariableNames, andsum(PredictorVariables)isnumpreds

Regardless, selected predictor variable

jMdl.Beta(:,.j)

PredictorVariables applies only when you specify

InSample.

The selected variables must be numeric vectors and cannot contain missing values

(NaN).

By default, irf excludes the regression component, regardless

of its presence in Mdl.

Example: PredictorVariables=["M1SL" "TB3MS" "UNRATE"]

Example: PredictorVariables=[true false true false] or

PredictorVariable=[1 3] selects the first and third table variables as

the response variables.

Data Types: double | logical | char | cell | string

Confidence level for the confidence bounds, specified as a numeric scalar in the interval [0,1].

For each period, randomly drawn confidence intervals cover the true response 100*Confidence% of the time.

The default value is 0.95, which implies that the confidence bounds represent 95% confidence intervals.

Example: Confidence=0.9 specifies 90% confidence

intervals.

Data Types: double

Note

NaNvalues inY0,X, andEindicate missing data.irfremoves missing data from these arguments by list-wise deletion. For each argument, if a row contains at least oneNaN,irfremoves the entire row.List-wise deletion reduces the sample size, can create irregular time series, and can cause

EandXto be unsynchronized.irfissues an error when any table or timetable input contains missing values.

Output Arguments

IRF of each variable, returned as a

numobs-by-numseries-by-numseries

numeric array. numobs is the value of NumObs.

Columns and pages correspond to the response variables in

Mdl.SeriesNames.

irf returns Response only in the

following situations:

You supply optional data inputs as numeric matrices.

Mdlis an estimated model fit to a numeric matrix of response data.

Response( is the

impulse response of variable t +

1,j,k)ktjtnumObs – 1, jnumseries, and

knumseries. For example,

Response(1,2,3) is the impulse response of variable

Mdl.SeriesName(3) at time

tMdl.SeriesName(2).

Lower confidence bounds, returned as a

numobs-by-numseries-by-numseries

numeric array. Elements of Lower correspond to elements of

Response.

irf returns Lower only in the

following situations:

You supply optional data inputs as numeric matrices.

Mdlis an estimated model fit to a numeric matrix of response data.

Lower( is the

lower bound of the t +

1,j,k)100*Confidence-th percentile interval on the

true impulse response of variable ktjLower(1,2,3) is the lower bound of the confidence interval on the

true impulse response of variable Mdl.SeriesName(3) at time

tMdl.SeriesName(2).

Upper confidence bounds, returned as a

numobs-by-numseries-by-numseries

numeric array. Elements of Upper correspond to elements of

Response.

irf returns Upper only in the

following situations:

You supply optional data inputs as numeric matrices.

Mdlis an estimated model fit to a numeric matrix of response data.

Upper( is the

upper bound of the t +

1,j,k)100*Confidence-th percentile interval on the

true impulse response of variable ktjUpper(1,2,3) is the upper bound of the confidence interval on the

true impulse response of variable Mdl.SeriesName(3) at time

tMdl.SeriesName(2).

Since R2022b

IRF and confidence bounds, returned as a table or timetable with

numobs rows. irf returns

Tbl only in the following situations:

You supply optional data inputs as tables or timetables.

Mdlis an estimated model fit to response data in a table or timetable.

Regardless, the data type of Tbl is the same as the

data type of specified data.

Variables in Tbl represent those response series being

shocked at time 0.

Variables containing IRFs have the following qualities:

For each response series in

Mdl.SeriesNames,irfnames the corresponding variableResponseJ_IRFResponseJMdl.Series(isj)GDP, the variableGDP_IRFcontains the IRFs of all response series resulting from a shock toGDPat time 0.Each variable contains a

numobs-by-numseriesnumeric matrix of resulting IRFs of all response series.numobsis the value ofNumObsandnumseriesis the value ofMdl.NumSeries.ResponseJ_IRF(is the impulse response of variablet+ 1,k)ktResponseJtnumObs– 1,Jnumseries, andknumseries.

When you set at least one name-value argument that controls the confidence bounds,

irfreturns the lower and upper confidence bounds on the true IRF of the response series. Variables containing the IRF confidence bounds have the following qualities:For each IRF

ResponseJ_IRFirfnames the corresponding lower and upper bound variablesResponseJ_IRF_LowerBoundResponseJ_IRF_UpperBoundResponseJGDP,GDP_IRF,Tblcontains variables for the corresponding lower and upper confidence boundsGDP_IRF_LowerBoundandGDP_IRF_UpperBound.Each confidence bound variable contains a

numobs-by-numseriesnumeric matrix.(

ResponseJ_IRF_LowerBound(t,k)ResponseJ_IRF_UpperBound(t,k)100*Confidence-th percentile confidence interval on the IRF of response seriesktResponseJtnumobs– 1,Jnumseries, andknumseries.

If Tbl is a timetable, the row order of Tbl,

either ascending or descending, matches the row order of InSample,

when you specify it. If you do not specify InSample and you specify

Presample, the row order of Tbl is the

same as the row order of Presample.

More About

An impulse response function (IRF) of a time series model (or dynamic response of the system) measures the changes in the future responses of all variables in the system when a variable is shocked by an impulse. In other words, the IRF at time t is the derivative of the responses at time t with respect to an innovation at time t0 (the time that innovation was shocked), t ≥ t0.

Consider a numseries-D VAR(p)

model for the multivariate response variable

yt. In lag operator notation, the infinite lag

MA representation of yt is

The general form of the IRF of yt shocked by an impulse to variable j by one standard deviation of its innovation m periods into the future is

ej is a selection vector of length

numseriescontaining a 1 in element j and zeros elsewhere.For the orthogonalized IRF, where P is the lower triangular factor in the Cholesky factorization of Σ, and Ωm is the lag m coefficient of Ω(L).

For the generalized IRF, where σj is the standard deviation of innovation j.

The IRF is free of the model constant, regression component, and time trend.

A vector autoregression (VAR) model is a stationary multivariate time series model consisting of a system of m equations of m distinct response variables as linear functions of lagged responses and other terms.

A VAR(p) model in difference-equation notation and in reduced form is

yt is a

numseries-by-1 vector of values corresponding tonumseriesresponse variables at time t, where t = 1,...,T. The structural coefficient is the identity matrix.c is a

numseries-by-1 vector of constants.Φj is a

numseries-by-numseriesmatrix of autoregressive coefficients, where j = 1,...,p and Φp is not a matrix containing only zeros.xt is a

numpreds-by-1 vector of values corresponding tonumpredsexogenous predictor variables.β is a

numseries-by-numpredsmatrix of regression coefficients.δ is a

numseries-by-1 vector of linear time-trend values.εt is a

numseries-by-1 vector of random Gaussian innovations, each with a mean of 0 and collectively anumseries-by-numseriescovariance matrix Σ. For t ≠ s, εt and εs are independent.

Condensed and in lag operator notation, the system is

where , Φ(L)yt is

the multivariate autoregressive polynomial, and I is the

numseries-by-numseries identity matrix.

Algorithms

If

Methodis"orthogonalized", then the resulting IRF depends on the order of the variables in the time series model. IfMethodis"generalized", then the resulting IRF is invariant to the order of the variables. Therefore, the two methods generally produce different results.If

Mdl.Covarianceis a diagonal matrix, then the resulting generalized and orthogonalized IRFs are identical. Otherwise, the resulting generalized and orthogonalized IRFs are identical only when the first variable shocks all variables (for example, all else being the same, both methods yield the same value ofResponse(:,1,:)).The predictor data in

XorInSamplerepresents a single path of exogenous multivariate time series. If you specifyXorInSampleand the modelMdlhas a regression component (Mdl.Betais not an empty array),irfapplies the same exogenous data to all paths used for confidence interval estimation.irfconducts a simulation to estimate the confidence boundsLowerandUpperor associated variables inTbl.If you do not specify residuals by supplying

Eor usingInSample,irfconducts a Monte Carlo simulation by following this procedure:Simulate

NumPathsresponse paths of lengthSampleSizefromMdl.Fit

NumPathsmodels that have the same structure asMdlto the simulated response paths. IfMdlcontains a regression component and you specify predictor data by supplyingXor usingInSample, thenirffits theNumPathsmodels to the simulated response paths and the same predictor data (the same predictor data applies to all paths).Estimate

NumPathsIRFs from theNumPathsestimated models.For each time point t = 0,…,

NumObs, estimate the confidence intervals by computing 1 –ConfidenceandConfidencequantiles (upper and lower bounds, respectively).

Otherwise,

irfconducts a nonparametric bootstrap by following this procedure:Resample, with replacement,

SampleSizeresiduals fromEorInSample. Perform this stepNumPathstimes to obtainNumPathspaths.Center each path of bootstrapped residuals.

Filter each path of centered, bootstrapped residuals through

Mdlto obtainNumPathsbootstrapped response paths of lengthSampleSize.Complete steps 2 through 4 of the Monte Carlo simulation, but replace the simulated response paths with the bootstrapped response paths.

References

[1] Hamilton, James D. Time Series Analysis. Princeton, NJ: Princeton University Press, 1994.

[2] Lütkepohl, Helmut. New Introduction to Multiple Time Series Analysis. New York, NY: Springer-Verlag, 2007.

[3] Pesaran, H. H., and Y. Shin. "Generalized Impulse Response Analysis in Linear Multivariate Models." Economic Letters. Vol. 58, 1998, pp. 17–29.

Version History

Introduced in R2019aIn addition to accepting input data in numeric arrays,

irf accepts input data in tables and timetables. irf chooses default series on which to operate, but you can use the following name-value arguments to select variables.

Presamplespecifies the input table or regular timetable of presample response data.PresampleResponseVariablesspecifies the response series names fromPresample.Insamplespecifies the table or regular timetable of residual and predictor data to compute bootstrap estimates.ResidualVariablesspecifies the residual series names inInSample.PredictorVariablesspecifies the predictor series inInSamplefor a model regression component.

MATLAB Command

You clicked a link that corresponds to this MATLAB command:

Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands.

웹사이트 선택

번역된 콘텐츠를 보고 지역별 이벤트와 혜택을 살펴보려면 웹사이트를 선택하십시오. 현재 계신 지역에 따라 다음 웹사이트를 권장합니다:

또한 다음 목록에서 웹사이트를 선택하실 수도 있습니다.

사이트 성능 최적화 방법

최고의 사이트 성능을 위해 중국 사이트(중국어 또는 영어)를 선택하십시오. 현재 계신 지역에서는 다른 국가의 MathWorks 사이트 방문이 최적화되지 않았습니다.

미주

- América Latina (Español)

- Canada (English)

- United States (English)

유럽

- Belgium (English)

- Denmark (English)

- Deutschland (Deutsch)

- España (Español)

- Finland (English)

- France (Français)

- Ireland (English)

- Italia (Italiano)

- Luxembourg (English)

- Netherlands (English)

- Norway (English)

- Österreich (Deutsch)

- Portugal (English)

- Sweden (English)

- Switzerland

- United Kingdom (English)