Price Weather Derivatives

This example demonstrates a workflow for pricing weather derivatives based on historically observed temperature data.

The workflow for pricing call and put options for weather derivatives includes these steps:

The techniques used in this example are based on the approach described in Alaton [1].

What Is a Weather Derivative?

A weather derivative is a financial instrument used by companies or individuals to hedge against the risk of weather-related losses. Weather derivatives are index-based instruments that use observed weather data at a weather station to create an index on which a payout is based. The seller of a weather derivative agrees to bear the risk of disasters in return for a premium. If no damages occur before the expiration of the contract, the seller makes a profit—and in the event of unexpected or adverse weather, the buyer of the derivative claims the agreed amount.

How to Price Weather Derivatives

A number of different contracts for weather derivatives are traded on the over-the-counter (OTC) market. This example explores a simple option (call or put) based on the accumulation of heating degree days (HDD), which are the number of degrees that the temperature deviates from a reference level on a given day.

There is no standard model for valuing weather derivatives similar to the Black-Scholes formula for pricing European equity options and similar derivatives. The underlying asset of the weather derivative is not tradeable, which violates a number of key assumptions of the Black-Scholes model. In this example, you price the option using the following formula from Alaton [1]:

In general, the process of pricing weather derivative options is: obtain temperature data, clean the temperature data, and model the temperature to forecast the option price.

Get Raw Temperature Data

All data in this example is obtained from NOAA. Use getGHCNData in Local Functions to extract the data, given a stationID and start and end dates. A REST API is also available for extracting data from NOAA. For more information on using a REST API, see Pricing weather derivatives GitHub.

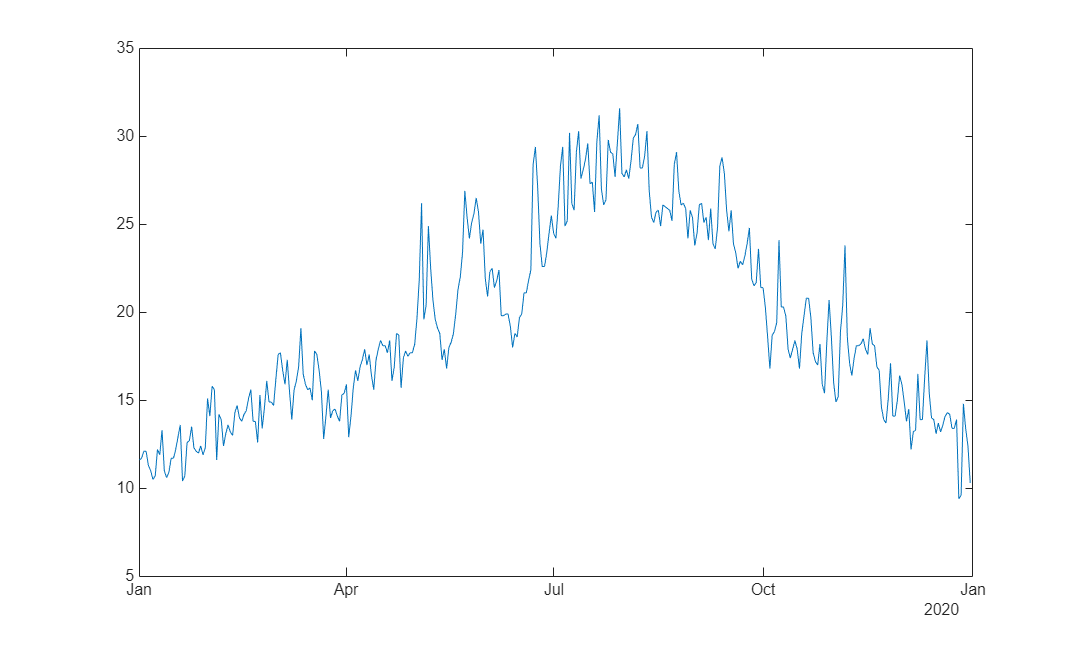

To obtain the full temperature data for one year and plot the results, use getGHCNData in Local Functions.

stationID = 'SPE00119783'; Element = 'TAVG'; startDate = datetime(2020,1,1); endDate = datetime(2020,12,31); T = getGHCNData(stationID,Element,startDate,endDate,false); head(T)

Date TAVG

___________ ____

01-Jan-2020 11.6

02-Jan-2020 11.7

03-Jan-2020 12.1

04-Jan-2020 12.1

05-Jan-2020 11.3

06-Jan-2020 11

07-Jan-2020 10.5

08-Jan-2020 10.7

figure plot(T.Date, T.TAVG)

Load and Process Observed Temperature Data

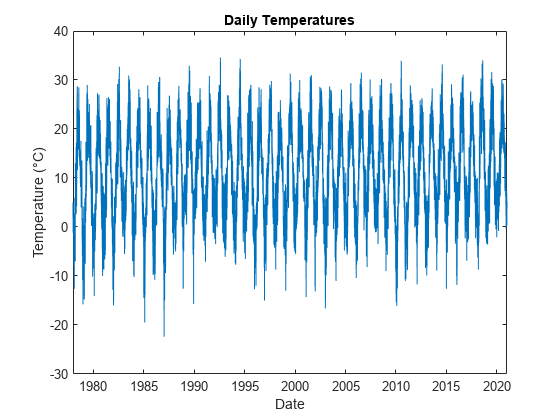

This example uses data containing temperatures from 1978 to the end of 2020 near Stockholm. You can obtain this data by using getGHCNData in Local Functions.

stationID = 'SW000008525'; Element = 'TMAX'; startDate = datetime(1978,1,1); endDate = datetime(2020,12,31); Temp = getGHCNData(stationID,Element,startDate,endDate,false)

Temp=15706×1 timetable

Date TMAX

___________ ____

01-Jan-1978 4.7

02-Jan-1978 5

03-Jan-1978 3.1

04-Jan-1978 -0.5

05-Jan-1978 -1.2

06-Jan-1978 2.7

07-Jan-1978 4.5

08-Jan-1978 4.9

09-Jan-1978 1.8

10-Jan-1978 3.2

11-Jan-1978 1.5

12-Jan-1978 -0.5

13-Jan-1978 0.6

14-Jan-1978 2

15-Jan-1978 2.5

16-Jan-1978 2.4

⋮

Visualize Temperatures

Use plotTemperature in Local Functions to visualize the daily temperatures.

figure plot( Temp.Date, Temp.TMAX) xlabel("Date") ylabel("Temperature (" + char(176) + "C)") title("Daily Temperatures")

In the remaining sections of this example, you model the temperature and then evaluate sample option prices.

Determine Seasonality in Data

Assume that the deterministic component of the temperature model comprises a linear trend and seasonal terms. To estimate the main frequencies present in the time series, apply the Fourier transform.

Use determineSeasonality in Local Functions to remove the linear trend by subtracting the best-fit line. Then, use the periodogram (Signal Processing Toolbox) function to compute the spectrum (with a sample rate of one observation per day), and to visualize the spectrum. In addition, the determineSeasonality function identifies the top two component frequencies and periods in the data and adds these to the power spectrum.

determineSeasonality(Temp)

The plot illustrates that the dominant seasonal components in the data are the annual and 6-monthly cycles.

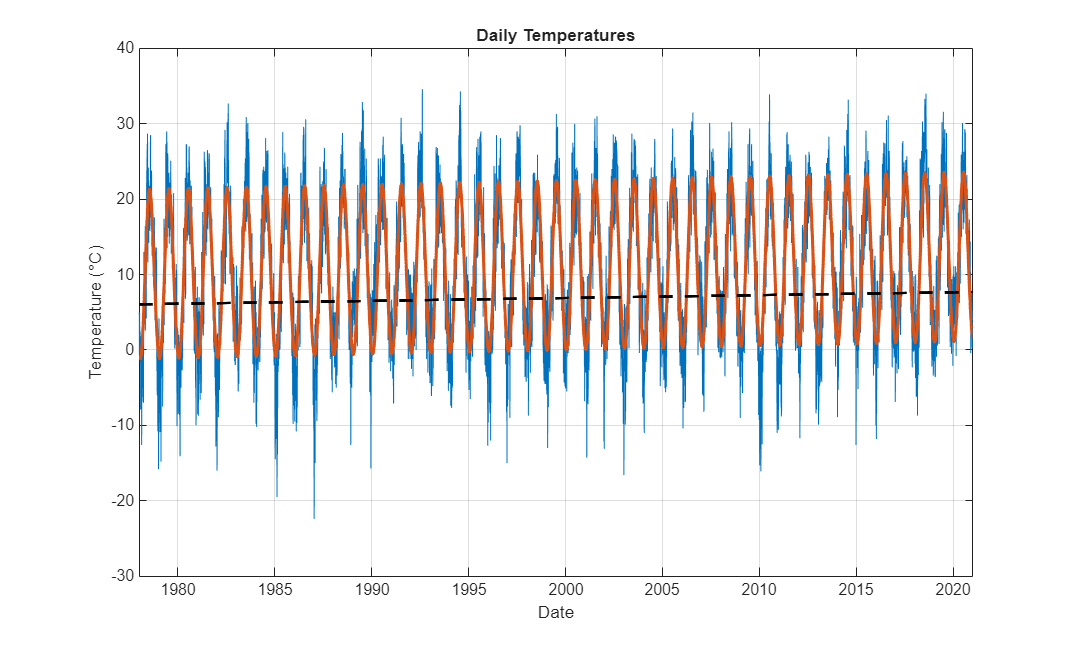

Fit Deterministic Trend

Based on the previous results, fit the following function for the temperature using the fitlm function.

elapsedTime = years(Temp.Date - Temp.Date(1)); designMatrix = @(t) [t, cos( 2 * pi * t ), sin( 2 * pi * t ), cos( 4 * pi * t )]; trendPreds = ["t", "cos(2*pi*t)", "sin(2*pi*t)", "cos(4*pi*t)"]; trendModel = fitlm(designMatrix(elapsedTime), Temp.TMAX, "VarNames", [trendPreds, "Temperature"])

trendModel =

Linear regression model:

Temperature ~ 1 + t + cos(2*pi*t) + sin(2*pi*t) + cos(4*pi*t)

Estimated Coefficients:

Estimate SE tStat pValue

________ _________ _______ __________

(Intercept) 9.7095 0.064138 151.39 0

t 0.054648 0.0025836 21.152 6.1629e-98

cos(2*pi*t) -10.909 0.045348 -240.56 0

sin(2*pi*t) -2.772 0.045357 -61.115 0

cos(4*pi*t) 0.39298 0.045348 8.6659 4.9102e-18

Number of observations: 15706, Error degrees of freedom: 15701

Root Mean Squared Error: 4.02

R-squared: 0.798, Adjusted R-Squared: 0.798

F-statistic vs. constant model: 1.55e+04, p-value = 0

Use the plotDeterministicTrend in Local Functions to visualize the fitted trend.

trendModel = plotDeterministicTrend(Temp, trendModel, 1978, 2020)

trendModel =

Linear regression model:

Temperature ~ 1 + t + cos(2*pi*t) + sin(2*pi*t) + cos(4*pi*t)

Estimated Coefficients:

Estimate SE tStat pValue

________ _________ _______ __________

(Intercept) 9.7095 0.064138 151.39 0

t 0.054648 0.0025836 21.152 6.1629e-98

cos(2*pi*t) -10.909 0.045348 -240.56 0

sin(2*pi*t) -2.772 0.045357 -61.115 0

cos(4*pi*t) 0.39298 0.045348 8.6659 4.9102e-18

Number of observations: 15706, Error degrees of freedom: 15701

Root Mean Squared Error: 4.02

R-squared: 0.798, Adjusted R-Squared: 0.798

F-statistic vs. constant model: 1.55e+04, p-value = 0

The coefficient of the term is significant with a value of 0.038. This value suggests that this geographic location has a warming trend of approximately 0.038°C per year.

Analyze and Fit Model Residuals

Create an ARIMA/GARCH model for the residuals using arima (Econometrics Toolbox).

Based on the preceding results, create a separate time-series model for the regression model residuals using the following workflow:

Create an

arima(Econometrics Toolbox) object and use theARMAterms help to model the autocorrelation in the residual series.Set the constant term to

0, since the regression model above already includes a constant.Use a -distribution for the innovation series.

Use a

garch(Econometrics Toolbox) model for the variance of the residuals to model the autocorrelation in the squared residuals.

trendRes = trendModel.Residuals.Raw; resModel = arima( "ARLags", 1, ... "MALags", 1, ... "Constant", 0, ... "Distribution", "t", ... "Variance", garch( 1, 1 ) ); resModel = estimate(resModel,trendRes);

ARIMA(1,0,1) Model (t Distribution):

Value StandardError TStatistic PValue

________ _____________ __________ __________

Constant 0 0 NaN NaN

AR{1} 0.76851 0.0063873 120.32 0

MA{1} 0.075024 0.010201 7.3546 1.9155e-13

DoF 10.369 0.75565 13.722 7.47e-43

GARCH(1,1) Conditional Variance Model (t Distribution):

Value StandardError TStatistic PValue

________ _____________ __________ __________

Constant 0.67469 0.091762 7.3527 1.9427e-13

GARCH{1} 0.82015 0.019319 42.452 0

ARCH{1} 0.070965 0.0069394 10.226 1.5123e-24

DoF 10.369 0.75565 13.722 7.47e-43

The residuals are not normally distributed or independent. Also, the residuals show evidence of GARCH effects.

Simulate Future Temperature Scenarios

Now that you have a calibrated temperature model, you can use it to simulate future temperature paths.

Prepare the simulation time.

nDays = 730; simDates = Temp.Date(end) + caldays(1:nDays).'; simTime = years(simDates - Temp.Date(1));

Use predict to predict the deterministic trend.

trendPred = predict(trendModel, designMatrix(simTime));

Simulate from the ARIMA/GARCH model using simulate (Econometrics Toolbox).

simRes = simulate(resModel, nDays, "NumPaths", 1000, "Y0", trendRes);

Add the deterministic trend to the simulated residuals.

simTemp = simRes + trendPred;

Use visualizeScenarios in Local Functions to visualize the temperature scenarios.

visualizeScenarios(Temp, simTemp, simDates)

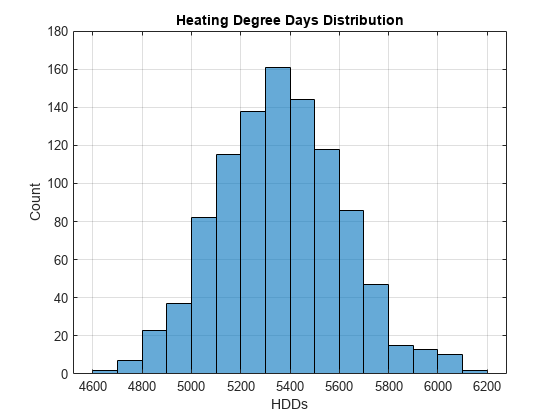

Evaluate Number of Heating Degree Days from Simulation

The number of heating degree days is given by , where are the simulated temperatures.

H = sum(max(18 - simTemp, 0)); figure histogram(H) xlabel("HDDs") ylabel("Count") title("Heating Degree Days Distribution") grid on

Using the original formula from Alaton [1], you can obtain a payoff distribution. When K = 7400, the max of H_n-K and 0 is always 0 for the set of simulation results in this example. Consequently, the histogram shows the distribution of 1000 zeros, that is, a single bar centered at 0 with a height of 1000. As K decreases to 5000, H_n-K has more opportunities to be positive, so the histogram changes shape.

K =5000; figure alpha = 1; chi = alpha*max(H-K, 0); % Payoff of option histogram(chi) title("Option Payoff Distribution")

Price Sample Call and Put Options

The weather derivative option pricing calculation is based on H (the number of heating degree days) which is defined in the Evaluate Number of Heating Degree Days From Simulation section.

First, compute the mean and standard deviation of H.

muH = mean(H); sigmaH = std(H);

Define the sample option parameters.

r = 0.01; % Risk-free interest rate K = 5000; % Strike value TTM = 0.25; % Expiry time

Evaluate α.

a = (K - muH) / sigmaH;

Compute the price of the call and put options.

call_option = exp(-r*TTM) * ((muH - K) * normcdf(-a) + (sigmaH / sqrt(2*pi) * exp(-0.5*a^2)))

call_option = 370.4625

put_option = exp(-r*TTM) * ((K - muH) * (normcdf(a) - normcdf(-muH / sigmaH)) + sigmaH / sqrt(2*pi) * (exp(-0.5*a^2) - exp(-0.5*(muH/sigmaH)^2)))

put_option = 8.6969

References

[1] Alaton, P., Djehiche, B. and D. Stillberger, D. On Modelling and Pricing Weather Derivatives. Applied Mathematical Finance. 9(1): 1–20, 2002.

[2] Climate Data Online: Web Services Documentation at https://www.ncdc.noaa.gov/cdo-web/webservices.

Local Functions

function TT_out = getGHCNData(stationID,Element,startDate,endDate,useNOAAinterface) % Function to retrieve GHCN Data % Set flag to use NOAA interface if ~exist("useNOAAinterface","var") || isempty(useNOAAinterface) useNOAAinterface = false; end % For more information on the NOAA interface, see % https://www.mathworks.com/matlabcentral/fileexchange/119213-matlab-interface-for-noaa-data % Get data using noaa interface or readtable from NOAA site if useNOAAinterface n = noaa("WebServicesTokenString"); % Must request data in 1 year increments yearRange = year([startDate;endDate]); TT_Full_From_NOAA = []; for y = yearRange(1):yearRange(2) TT_Full_Year = getdata(n,"GHCND",datetime(y,1,1),datetime(y,12,31),stationid = strcat("GHCND:",stationID),datatypeid = Element,limit = "1000"); TT_Full_From_NOAA = vertcat(TT_Full_From_NOAA,TT_Full_Year); %#ok Date = datetime(TT_Full_From_NOAA.date,"InputFormat",'uuuu-MM-dd''T''HH:mm:SS'); TT_out = timetable(Date,TT_Full_From_NOAA.value/10,'VariableNames',{Element}); end else % Import options for GHCN Data files. For more information, see: % https://www1.ncdc.noaa.gov/pub/data/ghcn/daily/readme.txt DataStartLine = 1; NumVariables = 31*4 + 4; varNames_Array = (["Value","MFlag","QFlag","SFlag"] + (1:31)')'; VariableNames = ["ID","Year","Month","Element",varNames_Array(:)']; VariableWidths = [11 4 2 4 repmat([5 1 1 1],1,31)]; DataType = [{'char','double','double','char'} ... repmat({'double' 'char' 'char' 'char'},1,31)]; opts = fixedWidthImportOptions('NumVariables',NumVariables, ... 'DataLines',DataStartLine, ... 'VariableNames',VariableNames, ... 'VariableWidths',VariableWidths, ... 'VariableTypes',DataType); % Read the full data set. TT_Full = readtable("https://www1.ncdc.noaa.gov/pub/data/ghcn/daily/all/" + ... stationID + ".dly",opts); % Extract the Element data. TT_Element_Full = TT_Full(TT_Full.Element == string(Element),["ID" "Year" ... "Month" "Element" "Value" + (1:31)]); reqYears = year(startDate):year(endDate); TT_Element = TT_Element_Full(ismember(TT_Element_Full.Year,reqYears),:); fullyearDays = datetime(year(startDate),1,1):datetime(year(endDate),12,31); tmpData = TT_Element{:,5:end}'; tmpData = tmpData(:); tmpData(tmpData == -9999) = []; % Remove any empty data Date = (startDate:endDate)'; reqIndex = ismember(fullyearDays,Date); TT_out = timetable(Date,tmpData(reqIndex)/10,'VariableNames',{Element}); end end function determineSeasonality(Temp) % Assume that the deterministic component of the temperature model comprises a linear trend and seasonal terms. % To estimate the main frequencies present in the time series, apply the Fourier transform. % First, remove the linear trend by subtracting the best-fit line. detrendedTemps = detrend(Temp.TMAX); % Next, use the periodogram function to compute the spectrum. The sampling frequency is one observation per day. numObs = length(detrendedTemps); Fs = 1; [pow, freq] = periodogram(detrendedTemps, [], numObs, Fs); % Visualize the spectrum. powdB = db(pow); figure plot(freq, powdB) xlabel("Frequency (days^{-1})") ylabel("Power (dB)") title("Detrended Temperatures Power Spectrum") grid on % Identify the top two component frequencies and periods in the data. [topPow, idx] = findpeaks(powdB, "NPeaks", 2, ... "SortStr", "descend", ... "MinPeakProminence", 20); topFreq = freq(idx); topPeriods = 1 ./ topFreq; % Add the top two component frequencies and periods to the spectrum. hold on plot(topFreq, topPow, "r^", "MarkerFaceColor", "r") xlim([min( topFreq ) - 1e-3, max( topFreq ) + 1e-3]) legend("Spectrum", "Top periods (days): " + join( string( topPeriods ), ", " )) % Note that the dominant seasonal components in the data are the annual and 6-monthly cycles. end function trendModel = plotDeterministicTrend(Temp, trendModel, from, to) % Visualize the fitted trend. figure; plot(Temp.Date, Temp.TMAX) xlabel("Date") ylabel("Temperature (" + char( 176 ) + "C)") title("Daily Temperatures") grid on hold on plot(Temp.Date, trendModel.Fitted, "LineWidth", 2) plot(Temp.Date,6.06+0.038*years(Temp.Date - Temp.Date(1)),'k--','LineWidth',2) xlim([datetime(from,1,1), datetime(to,12,31)]) end function visualizeScenarios(Temp, simTemp, simDates) figure plot(Temp.Date, Temp.TMAX) hold on plot(simDates, simTemp) % Plot the simulation percentiles. simPrc = prctile(simTemp, [2.5, 50, 97.5], 2); plot(simDates, simPrc, "y", "LineWidth", 1.5) xlim([Temp.Date(end) - calyears(1), simDates(end)]) xlabel("Date") ylabel("Temperature (" + char( 176 ) + "C)") title("Temperature Simulation") grid on % Get the data for 2021. stationID = 'SW000008525'; Element = 'TMAX'; startDate = datetime(2021,1,1); endDate = datetime(2021,12,31); T = getGHCNData(stationID,Element,startDate,endDate); plot(T.Date, T.TMAX, "g", "LineWidth", 1.5) end