setConditionalBudget

Description

obj = setConditionalBudget(obj,ConditionalBudgetThreshold,ConditionalUpperBudget)Portfolio,

PortfolioCVaR, or PortfolioMAD

objects. If the weight of an asset exceeds the

ConditionalBudgetThreshold value, the weight of that

asset is added to the aggregate sum that is bound by the

ConditionalUpperBudget value. For more information, see

Conditional Budget Constraints .

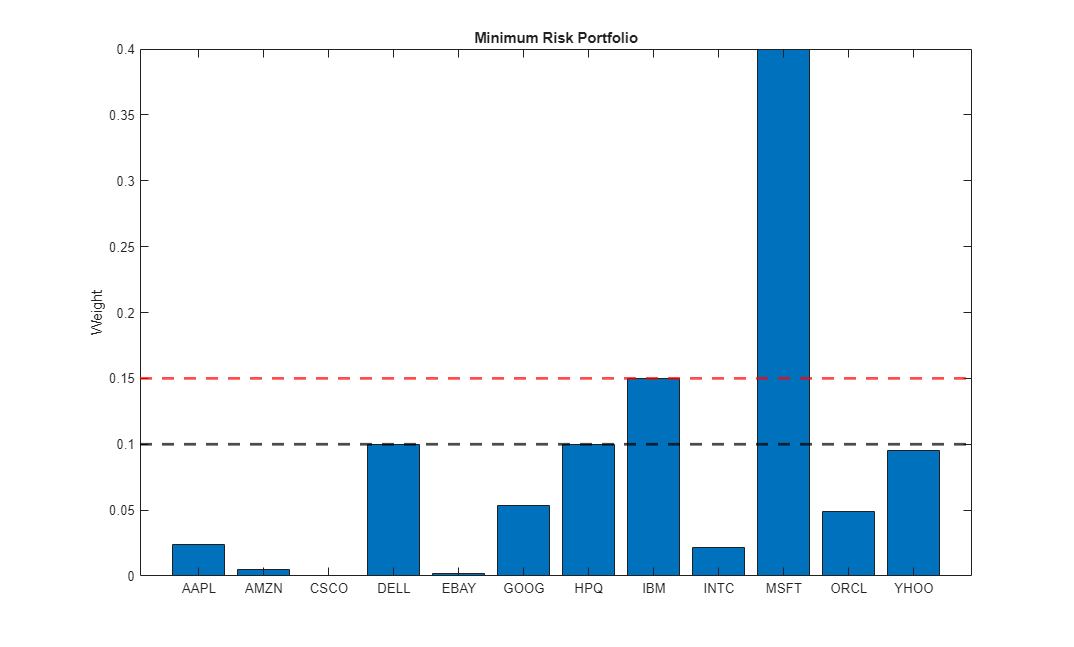

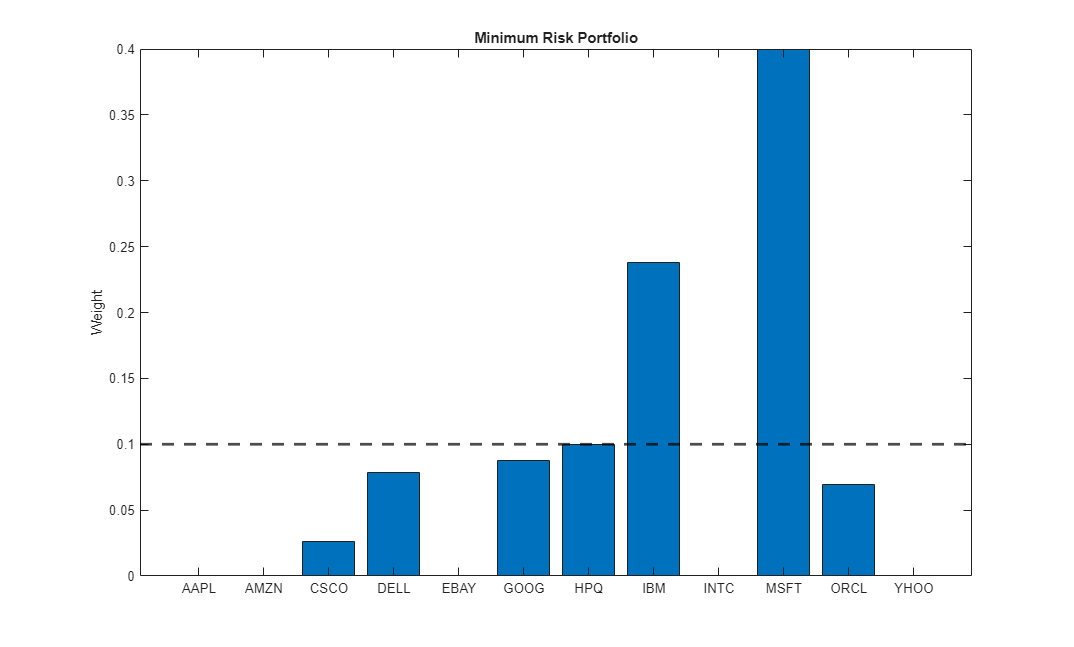

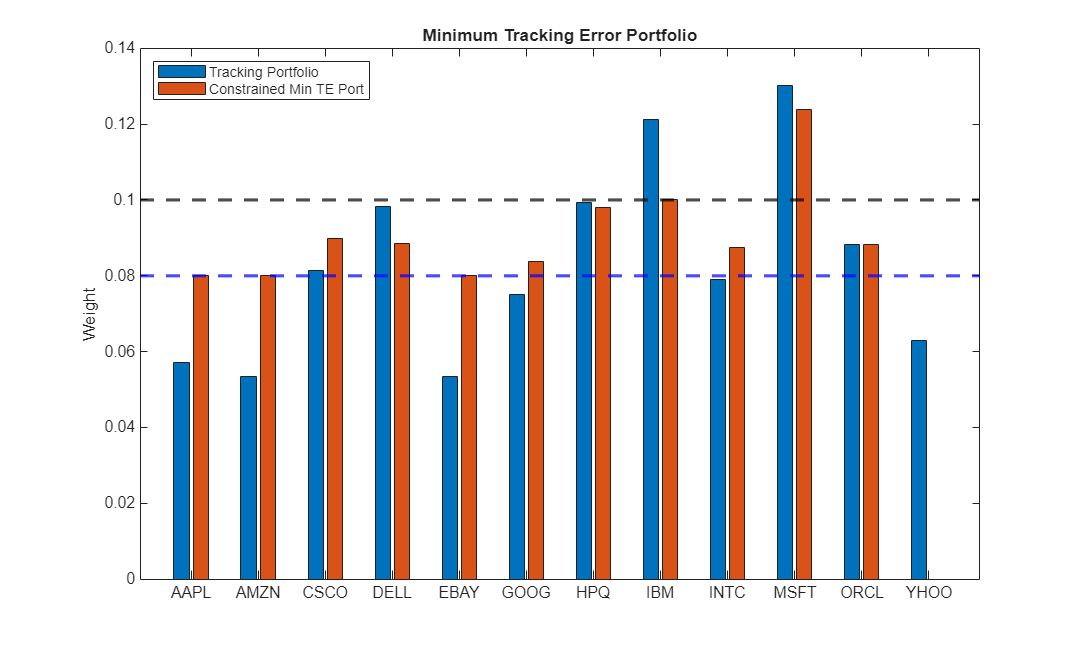

This constraint supports the Undertakings for Collective Investment in Transferable Securities (UCITS) Directive. The UCITS asset regulation states that any investments in excess of 5% must not exceed 40% of the total portfolio. This constraint is a conditional budget constraint. For more information, see Undertakings for Collective Investment in Transferable Securities and Adding Constraints to Satisfy UCITS Directive.

For details on the respective workflows when using these different objects, see Portfolio Object Workflow, PortfolioCVaR Object Workflow, and PortfolioMAD Object Workflow.

Examples

Input Arguments

Output Arguments

More About

Tips

You can also use dot notation to set up the conditional budget constraints.

obj = obj.setConditionalBudget(ConditionalBudgetThreshold,ConditionalUpperBudget);

Version History

Introduced in R2024b

See Also

Topics

- Adding Constraints to Satisfy UCITS Directive

- Conditional Budget Constraints

- Conditional Budget Constraints

- Conditional Budget Constraints

- Supported Constraints for Portfolio Optimization Using Portfolio Objects

- Supported Constraints for Portfolio Optimization Using PortfolioCVaR Object

- Supported Constraints for Portfolio Optimization Using PortfolioMAD Object