Analyze Performance Attribution Using Brinson Model

This example shows how to prepare data, create a brinsonAttribution object, and then analyze the performance attribution with respect to category (sector) weights and returns. In this example, you use the categoryAttribution, categoryReturns, categoryWeights, totalAttribution, and summary functions for the analysis. Also, you can generate plots for the results, using categoryReturnsChart, categoryWeightsChart, and attributionsChart.

Prepare Data

Load the stock price data into a table.

T = readtable('dowPortfolio.xlsx');

MonthIdx = [1;20;39;62;81;103;125;145;168;188;210;231;251];

MonthlyPrices = T(MonthIdx,3:end);Compute the monthly returns using tick2ret.

MonthlyReturns = tick2ret(MonthlyPrices.Variables)'; [NumAssets,NumPeriods] = size(MonthlyReturns);

Define the asset categories (sectors) using categorical.

Category = categorical(["Materials";"Financials";"Financials"; ... "Industrials";"Financials";"Industrials";"Materials"; ... "Communication Services";"Industrials";"Consumer Discretionary"; ... "Consumer Discretionary";"Industrials";"Information Technology"; ... "Information Technology";"Information Technology";"Health Care"; ... "Financials";"Consumer Staples";"Consumer Discretionary"; ... "Industrials";"Consumer Staples";"Health Care"; ... "Information Technology";"Health Care";"Consumer Staples"; ... "Communication Services";"Industrials";"Communication Services"; ... "Consumer Staples";"Energy"]); Category = repmat(Category,1,NumPeriods);

Define Benchmark and Portfolio Weights

Define the benchmark weight and the portfolio weights, by quarter, for each of the stock assets.

BenchmarkWeight = 1./length(MonthlyReturns).*ones(NumAssets, NumPeriods); PortfolioWeightQ1 = [0;0;0.022;0.033;0;0.044;0.022;0.011;0.065;0.033; ... 0.055;0.072;0;0.04;0;0.05;0.08;0.042;0.03;0.043;0.055;0.036;0.111; ... 0.036;0;0.03;0;0.05;0;0.04]*ones(1,3); PortfolioWeightQ2 = [0;0;0.022;0.033;0;0.044;0.022;0.011;0.049;0.033; ... 0.055;0.074;0;0.04;0;0.05;0.08;0.042;0.03;0.02;0.055;0.036;0.148; ... 0.036;0;0.03;0;0.05;0;0.04]*ones(1,3); PortfolioWeightQ3 = [0;0;0.022;0.033;0;0.042;0.022;0.01;0.049;0.033; ... 0.05;0.07;0;0.04;0;0.05;0.08;0.042;0.03;0.02;0.055;0.036;0.16; ... 0.036;0;0.03;0;0.05;0;0.04]*ones(1,3); PortfolioWeightQ4 = [0;0;0.022;0.033;0;0.042;0.02;0.01;0.039;0.033; ... 0.05;0.07;0;0.04;0;0.05;0.08;0.042;0.03;0.02;0.055;0.036;0.198; ... 0.036;0;0.03;0;0.03;0;0.034]*ones(1,3); PortfolioWeight = [PortfolioWeightQ1 PortfolioWeightQ2 ... PortfolioWeightQ3 PortfolioWeightQ4]; Period = (1:NumPeriods).*ones(NumAssets,1); Name = repmat(string(MonthlyPrices.Properties.VariableNames(:)),1,NumPeriods);

Create AssetTable Input

Use table to create the AssetTable input to use when creating a brinsonAttribution object.

AssetTable = table(Period(:), Name(:), ... MonthlyReturns(:), Category(:), ... PortfolioWeight(:), BenchmarkWeight(:), ... VariableNames=["Period", "Name","Return","Category",... "PortfolioWeight","BenchmarkWeight"])

AssetTable=360×6 table

Period Name Return Category PortfolioWeight BenchmarkWeight

______ ______ ___________ ______________________ _______________ _______________

1 "AA" 0.053621 Materials 0 0.033333

1 "AIG" -0.05964 Financials 0 0.033333

1 "AXP" -0.00019406 Financials 0.022 0.033333

1 "BA" -0.030162 Industrials 0.033 0.033333

1 "C" -0.055015 Financials 0 0.033333

1 "CAT" 0.17956 Industrials 0.044 0.033333

1 "DD" -0.090708 Materials 0.022 0.033333

1 "DIS" 0.037221 Communication Services 0.011 0.033333

1 "GE" -0.07381 Industrials 0.065 0.033333

1 "GM" 0.27273 Consumer Discretionary 0.033 0.033333

1 "HD" -0.016838 Consumer Discretionary 0.055 0.033333

1 "HON" 0.025457 Industrials 0.072 0.033333

1 "HPQ" 0.083598 Information Technology 0 0.033333

1 "IBM" -0.009235 Information Technology 0.04 0.033333

1 "INTC" -0.1685 Information Technology 0 0.033333

1 "JNJ" -0.066351 Health Care 0.05 0.033333

⋮

Create brinsonAttribution Object

Use brinsonAttribution to create a brinsonAttribution object.

BrinsonPAobj = brinsonAttribution(AssetTable)

BrinsonPAobj =

brinsonAttribution with properties:

NumAssets: 30

NumPortfolioAssets: 22

NumBenchmarkAssets: 30

NumPeriods: 12

NumCategories: 9

AssetName: [30×1 string]

AssetReturn: [30×12 double]

AssetCategory: [30×12 categorical]

PortfolioAssetWeight: [30×12 double]

BenchmarkAssetWeight: [30×12 double]

PortfolioCategoryReturn: [9×12 double]

BenchmarkCategoryReturn: [9×12 double]

PortfolioCategoryWeight: [9×12 double]

BenchmarkCategoryWeight: [9×12 double]

PortfolioReturn: 0.2234

BenchmarkReturn: 0.2046

ActiveReturn: 0.0188

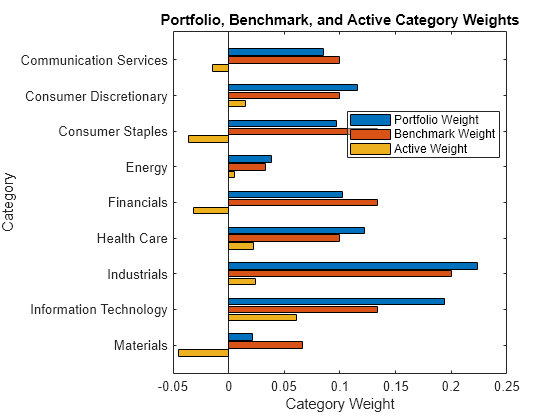

Compute Category Weights

Use the brinsonAttribution object and categoryWeights to compute the average and periodic category weights for the portfolio and the benchmark, as well as, the corresponding active weights.

[AverageCategoryWeights,PeriodicCategoryWeights] = categoryWeights(BrinsonPAobj)

AverageCategoryWeights=9×4 table

Category AveragePortfolioWeight AverageBenchmarkWeight AverageActiveWeight

______________________ ______________________ ______________________ ___________________

Communication Services 0.0855 0.1 -0.0145

Consumer Discretionary 0.1155 0.1 0.0155

Consumer Staples 0.097 0.13333 -0.036333

Energy 0.0385 0.033333 0.0051667

Financials 0.102 0.13333 -0.031333

Health Care 0.122 0.1 0.022

Industrials 0.22375 0.2 0.02375

Information Technology 0.19425 0.13333 0.060917

Materials 0.0215 0.066667 -0.045167

PeriodicCategoryWeights=108×5 table

Period Category PortfolioWeight BenchmarkWeight ActiveWeight

______ ______________________ _______________ _______________ ____________

1 Communication Services 0.091 0.1 -0.009

1 Consumer Discretionary 0.118 0.1 0.018

1 Consumer Staples 0.097 0.13333 -0.036333

1 Energy 0.04 0.033333 0.0066667

1 Financials 0.102 0.13333 -0.031333

1 Health Care 0.122 0.1 0.022

1 Industrials 0.257 0.2 0.057

1 Information Technology 0.151 0.13333 0.017667

1 Materials 0.022 0.066667 -0.044667

2 Communication Services 0.091 0.1 -0.009

2 Consumer Discretionary 0.118 0.1 0.018

2 Consumer Staples 0.097 0.13333 -0.036333

2 Energy 0.04 0.033333 0.0066667

2 Financials 0.102 0.13333 -0.031333

2 Health Care 0.122 0.1 0.022

2 Industrials 0.257 0.2 0.057

⋮

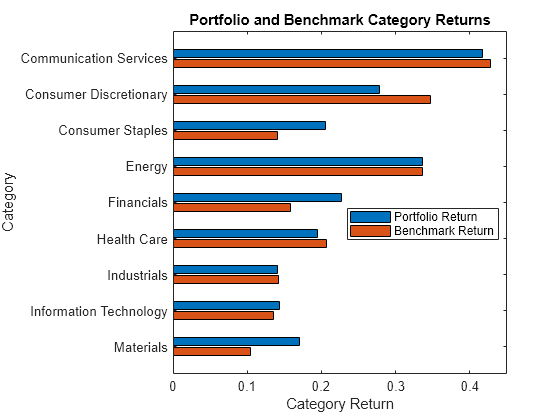

Compute Category Returns

Use the brinsonAttribution object and categoryReturns to compute the aggregate and periodic category (sector) returns for the portfolio and the benchmark.

[AggregateCategoryReturns,PeriodicCategoryReturns] = categoryReturns(BrinsonPAobj)

AggregateCategoryReturns=9×3 table

Category AggregatePortfolioReturn AggregateBenchmarkReturn

______________________ ________________________ ________________________

Communication Services 0.41756 0.42797

Consumer Discretionary 0.27772 0.34718

Consumer Staples 0.20572 0.14112

Energy 0.33598 0.33598

Financials 0.22678 0.15838

Health Care 0.19451 0.20679

Industrials 0.14132 0.14253

Information Technology 0.14339 0.13485

Materials 0.17109 0.10402

PeriodicCategoryReturns=108×4 table

Period Category PortfolioReturn BenchmarkReturn

______ ______________________ _______________ _______________

1 Communication Services 0.056262 0.052385

1 Consumer Discretionary 0.079767 0.10017

1 Consumer Staples -0.01485 -0.0033588

1 Energy 0.073093 0.073093

1 Financials -0.0021179 -0.029374

1 Health Care 0.012124 0.022297

1 Industrials 0.0018686 0.0088589

1 Information Technology 0.033481 -0.011315

1 Materials -0.090708 -0.018543

2 Communication Services 0.069253 0.078033

2 Consumer Discretionary -0.023091 -0.036416

2 Consumer Staples 0.0027749 0.00096619

2 Energy -0.0487 -0.0487

2 Financials 0.033379 0.02054

2 Health Care 0.014975 0.015929

2 Industrials 0.047732 0.041906

⋮

Compute Category Attribution

Use the brinsonAttribution object and categoryAttribution to compute the performance attribution of the portfolio for each category (sector).

[AggregateCategoryAttribution,PeriodicCategoryAttribution] = categoryAttribution(BrinsonPAobj)

AggregateCategoryAttribution=9×5 table

Category Allocation Selection Interaction ActiveReturn

______________________ __________ ___________ ___________ ____________

Communication Services -0.0025318 -0.00071062 0.0002061 -0.0030363

Consumer Discretionary 0.0024505 -0.00678 -0.0011609 -0.0054903

Consumer Staples 0.0023692 0.0093618 -0.0025511 0.00918

Energy 0.00038824 1.3872e-19 2.7745e-20 0.00038824

Financials 0.0013464 0.0097268 -0.0022858 0.0087874

Health Care 0.00011567 -0.0013031 -0.00028667 -0.0014741

Industrials 0.0016701 -0.00035051 -5.7623e-05 0.001262

Information Technology 0.0015686 0.0017812 0.00016898 0.0035187

Materials 0.0040725 0.0050687 -0.0034678 0.0056734

PeriodicCategoryAttribution=108×7 table

Period LinkingCoefficient Category Allocation Selection Interaction ActiveReturn

______ __________________ ______________________ ___________ ___________ ___________ ____________

1 1.1901 Communication Services -0.00034021 0.00038766 -3.489e-05 1.2564e-05

1 1.1901 Consumer Discretionary 0.0015405 -0.0020403 -0.00036725 -0.00086699

1 1.1901 Consumer Staples 0.00065192 -0.0015322 0.00041752 -0.00046274

1 1.1901 Energy 0.00039006 0 0 0.00039006

1 1.1901 Financials 0.0013774 0.0036342 -0.00085403 0.0041575

1 1.1901 Health Care 0.00016968 -0.0010173 -0.0002238 -0.0010714

1 1.1901 Industrials -0.00032634 -0.0013981 -0.00039845 -0.0021229

1 1.1901 Information Technology -0.00045756 0.0059728 0.0007914 0.0063066

1 1.1901 Materials 0.0014797 -0.004811 0.0032234 -0.00010793

2 1.1935 Communication Services -0.00058016 -0.000878 7.902e-05 -0.0013791

2 1.1935 Consumer Discretionary -0.00089975 0.0013325 0.00023985 0.00067261

2 1.1935 Consumer Staples 0.00045794 0.00024116 -6.5715e-05 0.00063338

2 1.1935 Energy -0.00041514 0 0 -0.00041514

2 1.1935 Financials -0.00021838 0.0017119 -0.0004023 0.0010912

2 1.1935 Health Care 5.19e-05 -9.5418e-05 -2.0992e-05 -6.451e-05

2 1.1935 Industrials 0.0016152 0.0011651 0.00033205 0.0031123

⋮

Compute Total Attribution

Use the brinsonAttribution object and totalAttribution to compute the total performance attribution of the portfolio summed up for all categories (sectors).

[AggregateTotalAttribution,PeriodicTotalAttribution] = totalAttribution(BrinsonPAobj)

AggregateTotalAttribution=1×4 table

Allocation Selection Interaction ActiveReturn

__________ _________ ___________ ____________

0.011449 0.016794 -0.0094348 0.018809

PeriodicTotalAttribution=12×6 table

Period LinkingCoefficient Allocation Selection Interaction ActiveReturn

______ __________________ ___________ ___________ ___________ ____________

1 1.1901 0.0044852 -0.00080413 0.0025538 0.0062349

2 1.1935 0.00087285 0.0032617 -0.0025973 0.0015372

3 1.1904 -6.9025e-05 0.0052394 0.00069386 0.0058643

4 1.208 -0.004707 -0.0095748 -0.0046622 -0.018944

5 1.1995 -0.00030704 -0.006091 -0.00061525 -0.0070132

6 1.1935 0.0012025 -0.00026724 0.00058932 0.0015246

7 1.1813 0.0032236 0.017541 -0.0021062 0.018658

8 1.196 0.004629 -0.004929 -0.0018038 -0.0021038

9 1.1927 0.0013046 0.00036681 0.00099195 0.0026634

10 1.1923 0.0032172 0.0023077 -0.0023663 0.0031586

11 1.194 -0.001881 0.00044958 0.0022018 0.00077039

12 1.1918 -0.0022819 0.0069324 -0.0007375 0.003913

Generate Summary for Performance Attribution

Use the brinsonAttribution object and summary to generate a table that summarizes the final results (aggregated over all time periods and categories) of the performance attribution using the Brinson model.

SummaryTable = summary(BrinsonPAobj)

SummaryTable=11×1 table

Brinson Attribution Summary

___________________________

Total Number of Assets 30

Number of Assets in Portfolio 22

Number of Assets in Benchmark 30

Number of Periods 12

Number of Categories 9

Portfolio Return 0.22345

Benchmark Return 0.20464

Active Return 0.018809

Allocation Effect 0.011449

Selection Effect 0.016794

Interaction Effect -0.0094348

Generate Horizontal Bar Charts for Returns, Weights, and Performance Attribution

Use the brinsonAttribution object and categoryReturnsChart, categoryWeightsChart, and attributionsChart to generate horizontal bar charts.

categoryReturnsChart(BrinsonPAobj)

categoryWeightsChart(BrinsonPAobj)

attributionsChart(BrinsonPAobj, Style="stacked")

See Also

brinsonAttribution | categoryAttribution | categoryReturns | categoryWeights | totalAttribution | summary