Creating the PortfolioCVaR Object

To create a fully specified CVaR portfolio optimization problem, instantiate the

PortfolioCVaR object using PortfolioCVaR. For information on the workflow when using

PortfolioCVaR objects, see PortfolioCVaR Object Workflow.

Syntax

Use PortfolioCVaR to create an instance

of an object of the PortfolioCVaR class. You can use PortfolioCVaR object in several ways.

To set up a portfolio optimization problem in a PortfolioCVaR

object, the simplest syntax

is:

p = PortfolioCVaR;

PortfolioCVaR object, p, such

that all object properties are empty. The PortfolioCVaR object also accepts

collections of argument name-value pair arguments for properties and their values.

The PortfolioCVaR object accepts inputs

for public properties with the general

syntax:

p = PortfolioCVaR('property1', value1, 'property2', value2, ... );If a PortfolioCVaR object already exists, the syntax permits

the first (and only the first argument) of PortfolioCVaR to be an existing

object with subsequent argument name-value pair arguments for properties to be added

or modified. For example, given an existing PortfolioCVaR object

in p, the general syntax

is:

p = PortfolioCVaR(p, 'property1', value1, 'property2', value2, ... );

Input argument names are not case-sensitive, but must be completely specified. In

addition, several properties can be specified with alternative argument names (see

Shortcuts for Property Names). The PortfolioCVaR object tries to detect

problem dimensions from the inputs and, once set, subsequent inputs can undergo

various scalar or matrix expansion operations that simplify the overall process to

formulate a problem. In addition, a PortfolioCVaR object is a

value object so that, given portfolio p, the following code

creates two objects, p and q, that are

distinct:

q = PortfolioCVaR(p, ...)

PortfolioCVaR Problem Sufficiency

A CVaR portfolio optimization problem is completely specified with the

PortfolioCVaR object if the following three conditions are

met:

You must specify a collection of asset returns or prices known as scenarios such that all scenarios are finite asset returns or prices. These scenarios are meant to be samples from the underlying probability distribution of asset returns. This condition can be satisfied by the

setScenariosfunction or with several canned scenario simulation functions.The set of feasible portfolios must be a nonempty compact set, where a compact set is closed and bounded. You can satisfy this condition using an extensive collection of properties that define different types of constraints to form a set of feasible portfolios. Since such sets must be bounded, either explicit or implicit constraints can be imposed and several tools, such as the

estimateBoundsfunction, provide ways to ensure that your problem is properly formulated.You must specify a probability level to locate the level of tail loss above which the conditional value-at-risk is to be minimized. This condition can be satisfied by the

setProbabilityLevelfunction.Although the general sufficient conditions for CVaR portfolio optimization go beyond the first three conditions, the

PortfolioCVaRobject handles all these additional conditions.

PortfolioCVaR Function Examples

If you create a PortfolioCVaR object, p,

with no input arguments, you can display it using

disp:

p = PortfolioCVaR; disp(p)

PortfolioCVaR with properties:

BuyCost: []

SellCost: []

RiskFreeRate: []

ProbabilityLevel: []

Turnover: []

BuyTurnover: []

SellTurnover: []

NumScenarios: []

Name: []

NumAssets: []

AssetList: []

InitPort: []

AInequality: []

bInequality: []

AEquality: []

bEquality: []

LowerBound: []

UpperBound: []

LowerBudget: []

UpperBudget: []

GroupMatrix: []

LowerGroup: []

UpperGroup: []

GroupA: []

GroupB: []

LowerRatio: []

UpperRatio: []

MinNumAssets: []

MaxNumAssets: []

ConditionalBudgetThreshold: []

ConditionalUpperBudget: []

BoundType: []The approaches listed provide a way to set up a portfolio optimization problem

with the PortfolioCVaR object. The custom set

functions offer additional ways to set and modify collections of properties in the

PortfolioCVaR object.

Using the PortfolioCVaR Function for a Single-Step Setup

You can use the PortfolioCVaR object to directly

set up a “standard” portfolio optimization problem. Given

scenarios of asset returns in the variable AssetScenarios,

this problem is completely specified as

follows:

m = [ 0.05; 0.1; 0.12; 0.18 ];

C = [ 0.0064 0.00408 0.00192 0;

0.00408 0.0289 0.0204 0.0119;

0.00192 0.0204 0.0576 0.0336;

0 0.0119 0.0336 0.1225 ];

m = m/12;

C = C/12;

AssetScenarios = mvnrnd(m, C, 20000);

p = PortfolioCVaR('Scenarios', AssetScenarios, ...

'LowerBound', 0, 'LowerBudget', 1, 'UpperBudget', 1, ...

'ProbabilityLevel', 0.95)

p =

PortfolioCVaR with properties:

BuyCost: []

SellCost: []

RiskFreeRate: []

ProbabilityLevel: 0.9500

Turnover: []

BuyTurnover: []

SellTurnover: []

NumScenarios: 20000

Name: []

NumAssets: 4

AssetList: []

InitPort: []

AInequality: []

bInequality: []

AEquality: []

bEquality: []

LowerBound: [4×1 double]

UpperBound: []

LowerBudget: 1

UpperBudget: 1

GroupMatrix: []

LowerGroup: []

UpperGroup: []

GroupA: []

GroupB: []

LowerRatio: []

UpperRatio: []

MinNumAssets: []

MaxNumAssets: []

ConditionalBudgetThreshold: []

ConditionalUpperBudget: []

BoundType: []

LowerBound property value undergoes

scalar expansion since AssetScenarios provides the dimensions

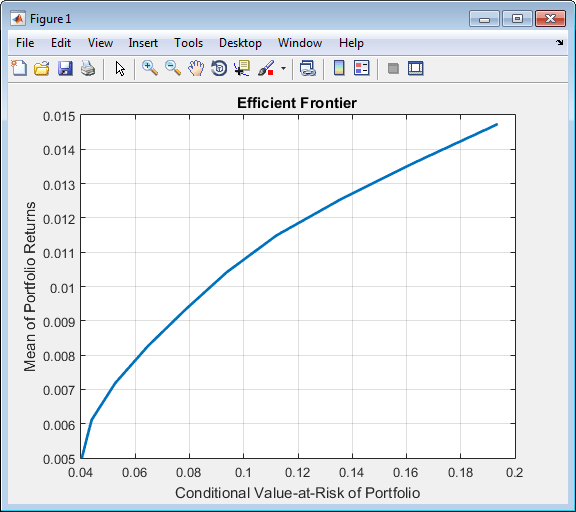

of the problem.You can use dot notation with the function plotFrontier.

p.plotFrontier

Using the PortfolioCVaR Function with a Sequence of Steps

An alternative way to accomplish the same task of setting up a

“standard” CVaR portfolio optimization problem, given

AssetScenarios variable is:

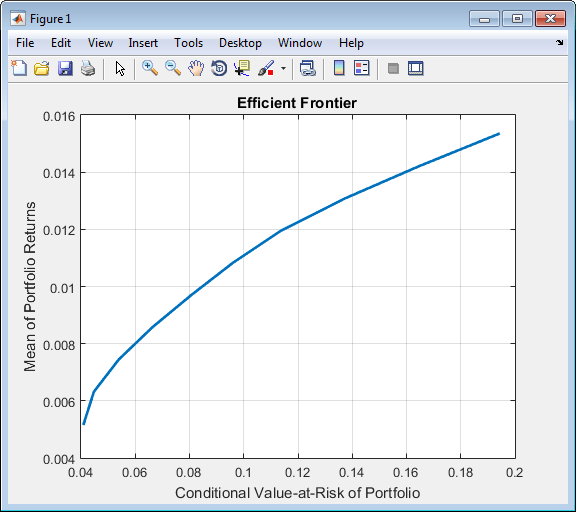

m = [ 0.05; 0.1; 0.12; 0.18 ]; C = [ 0.0064 0.00408 0.00192 0; 0.00408 0.0289 0.0204 0.0119; 0.00192 0.0204 0.0576 0.0336; 0 0.0119 0.0336 0.1225 ]; m = m/12; C = C/12; AssetScenarios = mvnrnd(m, C, 20000); p = PortfolioCVaR; p = setScenarios(p, AssetScenarios); p = PortfolioCVaR(p, 'LowerBound', 0); p = PortfolioCVaR(p, 'LowerBudget', 1, 'UpperBudget', 1); p = setProbabilityLevel(p, 0.95); plotFrontier(p)

This way works because the calls to the are in this particular

order. In this case, the call to initialize AssetScenarios

provides the dimensions for the problem. If you were to do this step last, you

would have to explicitly dimension the LowerBound property as follows:

m = [ 0.05; 0.1; 0.12; 0.18 ]; C = [ 0.0064 0.00408 0.00192 0; 0.00408 0.0289 0.0204 0.0119; 0.00192 0.0204 0.0576 0.0336; 0 0.0119 0.0336 0.1225 ]; m = m/12; C = C/12; AssetScenarios = mvnrnd(m, C, 20000); p = PortfolioCVaR; p = PortfolioCVaR(p, 'LowerBound', zeros(size(m))); p = PortfolioCVaR(p, 'LowerBudget', 1, 'UpperBudget', 1); p = setProbabilityLevel(p, 0.95); p = setScenarios(p, AssetScenarios);

Note

If you did not specify the size of LowerBound but,

instead, input a scalar argument, the PortfolioCVaR object

assumes that you are defining a single-asset problem and produces an

error at the call to set asset scenarios with four assets.

Shortcuts for Property Names

The PortfolioCVaR object has shorter

argument names that replace longer argument names associated with specific

properties of the PortfolioCVaR object. For example, rather

than enter 'ProbabilityLevel', the PortfolioCVaR object accepts the

case-insensitive name 'plevel' to set the

ProbabilityLevel property in a

PortfolioCVaR object. Every shorter argument name

corresponds with a single property in the PortfolioCVaR object. The one

exception is the alternative argument name 'budget', which

signifies both the LowerBudget and

UpperBudget properties. When 'budget'

is used, then the LowerBudget and

UpperBudget properties are set to the same value to form

an equality budget constraint.

Shortcuts for Property Names

Shortcut Argument Name | Equivalent Argument / Property Name |

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For example, this call to the PortfolioCVaR object uses these

shortcuts for

properties:

m = [ 0.05; 0.1; 0.12; 0.18 ]; C = [ 0.0064 0.00408 0.00192 0; 0.00408 0.0289 0.0204 0.0119; 0.00192 0.0204 0.0576 0.0336; 0 0.0119 0.0336 0.1225 ]; m = m/12; C = C/12; AssetScenarios = mvnrnd(m, C, 20000); p = PortfolioCVaR('scenario', AssetScenarios, 'lb', 0, 'budget', 1, 'plevel', 0.95); plotFrontier(p)

Direct Setting of Portfolio Object Properties

Although not recommended, you can set properties directly using dot notation, however no error-checking is done on your inputs:

m = [ 0.05; 0.1; 0.12; 0.18 ];

C = [ 0.0064 0.00408 0.00192 0;

0.00408 0.0289 0.0204 0.0119;

0.00192 0.0204 0.0576 0.0336;

0 0.0119 0.0336 0.1225 ];

m = m/12;

C = C/12;

AssetScenarios = mvnrnd(m, C, 20000);

p = PortfolioCVaR;

p = setScenarios(p, AssetScenarios);

p.ProbabilityLevel = 0.95;

p.LowerBudget = 1;

p.UpperBudget = 1;

p.LowerBound = zeros(size(m));

plotFrontier(p)

Note

Scenarios cannot be assigned directly using dot notation to a

PortfolioCVaR object. Scenarios must always be

set through either the PortfolioCVaR object, the

setScenarios function,

or any of the scenario simulation functions.

See Also

PortfolioCVaR | estimateBounds

Topics

- Common Operations on the PortfolioCVaR Object

- Working with CVaR Portfolio Constraints Using Defaults

- Hedging Using CVaR Portfolio Optimization

- Compute Maximum Reward-to-Risk Ratio for CVaR Portfolio

- PortfolioCVaR Object

- Portfolio Optimization Theory

- PortfolioCVaR Object Workflow