irbootstrap

Bootstrap interest-rate curve from market data

Description

outCurve = irbootstrap(BootInstruments,Settle)outCurve output is a ratecurve object.

outCurve = irbootstrap(___,Name,Value)OutCurve =

irbootstrap(Settle,BootInstruments,'Type',"zero",'Compounding',2,'Basis',5,'InterpMethod',"cubic")

bootstraps a zero curve from BootInstruments.

Examples

Define Deposit and Swap Parameters

Settle = datetime(2018,3,21);

DepRates = [.0050769 .0054934 .0061432 .0072388 .0093263]';

DepTimes = [1 2 3 6 12]';

DepDates = datemnth(Settle,DepTimes);

nDeposits = length(DepTimes);

SwapRates = [.0112597 0;.0128489 0;.0138917 0;.0146135 0;.0151175 0;...

.0155184 0;.0158536 0;.0161435 0];

SwapTimes = (2:9)';

SwapDates = datemnth(Settle,12*SwapTimes);

nSwaps = length(SwapTimes);

nInst = nDeposits + nSwaps;Create a Vector of Market Swap Instruments

Use fininstrument to create a vector of market Deposit and Swap instrument objects.

BootInstruments(nInst,1) = fininstrument.FinInstrument; for ii=1:length(DepDates) BootInstruments(ii) = fininstrument("deposit",'Maturity',DepDates(ii),'Rate',DepRates(ii)); end for ii=1:length(SwapDates) BootInstruments(ii+nDeposits) = fininstrument("swap",'Maturity',SwapDates(ii),'LegRate',[SwapRates(ii) 0]); end

Create ratecurve Object for Zero-Rate Curve

Use irbootstrap to create a ratecurve object for the zero-rate curve.

ZeroCurve = irbootstrap(BootInstruments,Settle)

ZeroCurve =

ratecurve with properties:

Type: "zero"

Compounding: -1

Basis: 0

Dates: [13×1 datetime]

Rates: [13×1 double]

Settle: 21-Mar-2018

InterpMethod: "linear"

ShortExtrapMethod: "next"

LongExtrapMethod: "previous"

This example shows how to create a ratecurve object using irbootstrap with Deposit and Swap instruments and a DiscountCurve for discounting cash flows.

Settle = datetime(2021,4,15); crvDates = Settle + [calmonths([1 2 3 6]) calyears([1 2 3 5 7 10 20 30])]'; crvRates = [0.0004 0.0004 0.0005 0.0006 0.0008 0.0018 0.0037 0.0088 0.013 0.0165 0.022 0.0233]'; DiscountCurve = ratecurve("zero",Settle,crvDates,crvRates); DepRates = [0.002 0.0021 0.0023 0.0024 .0028]'; DepDates = Settle + calmonths([1 2 3 6 12]'); SwapRates = [0.0041 0;0.0057 0;0.017 0;0.0193 0;0.024 0;0.027 0]; SwapTimes = [2 3 5 10 20 30]'; SwapDates = datemnth(Settle,12*SwapTimes); BootInstruments = [fininstrument("deposit","Maturity",DepDates,"Rate",DepRates); ... fininstrument("swap","Maturity",SwapDates,"LegRate",SwapRates)]; ZeroCurve = irbootstrap(BootInstruments,Settle,'DiscountCurve',DiscountCurve)

ZeroCurve =

ratecurve with properties:

Type: "zero"

Compounding: -1

Basis: 0

Dates: [11×1 datetime]

Rates: [11×1 double]

Settle: 15-Apr-2021

InterpMethod: "linear"

ShortExtrapMethod: "next"

LongExtrapMethod: "previous"

Create a BootInstruments variable as an input argument to irbootstrap to create a ratecurve object. The BootInstruments variable has OISFuture instrument objects for one-month SOFR Futures and three-month SOFR Futures, and an OvernightIndexedSwap instrument object.

Create Instruments

Use fininstrument to create an OISFuture instrument object for one-month SOFR Futures.

Settle = datetime(2021,3,4); HFDates = datetime(2021,3,1) + caldays(0:3)'; HistFixing = timetable(HFDates,[0.02;0.04;0.04;0.02]); % Data from the following: https://www.cmegroup.com/trading/interest-rates/stir/one-month-sofr_quotes_globex.html Prices_1M = [99.97 99.96 99.95]'; Maturity_1M = lbusdate(2021,[3 4 5]',[],[],'datetime'); StartDate_1M = fbusdate(2021,[3 4 5]',[],[],'datetime'); FutInstruments_1M = fininstrument("OISFuture","Maturity",Maturity_1M ,"QuotedPrice",Prices_1M,"StartDate",StartDate_1M,"Method","Average",... 'HistoricalFixing',HistFixing,'Name',"1MonthSOFRFuture")

FutInstruments_1M=3×1 OISFuture array with properties:

QuotedPrice

Method

Basis

StartDate

Maturity

Notional

BusinessDayConvention

Holidays

ProjectionCurve

HistoricalFixing

Name

Use fininstrument to create an OISFuture instrument object for three-month SOFR Futures.

% Data from the following: https://www.cmegroup.com/trading/interest-rates/stir/three-month-sofr_quotes_globex.html Prices_3M = [99.92 99.895 99.84 99.74]'; Dates_3M_Maturity = thirdwednesday([6 9 12 3]',[2021 2021 2021 2022]','datetime'); Dates_3M_Start = thirdwednesday([3 6 9 12]',2021,'datetime'); FutInstruments_3M = fininstrument("OISFuture","Maturity",Dates_3M_Maturity,... "QuotedPrice",Prices_3M,"StartDate",Dates_3M_Start,'HistoricalFixing',HistFixing,'Name',"3MonthSOFRFuture");

Use fininstrument to create an OvernightIndexedSwap instrument object.

SOFRSwapRates = [.0023 0;.0064 0;.013 0;.017 0;.0175 0]; SOFRSwapTimes = [3 5 10 20 30]; SOFRSwapDates = datemnth(Settle,12*SOFRSwapTimes)'; SOFRSwapInstruments = fininstrument("OvernightIndexedSwap","Maturity",SOFRSwapDates,"LegRate",SOFRSwapRates,'Name',"overnight_swap_instrument")

SOFRSwapInstruments=5×1 OvernightIndexedSwap array with properties:

LegRate

LegType

Reset

Basis

Notional

HistoricalFixing

ResetOffset

PaymentDelay

ProjectionCurve

BusinessDayConvention

Holidays

EndMonthRule

DaycountAdjustedCashFlow

StartDate

Maturity

Name

Define BootInstruments for the three types of instruments.

BootInstruments = [FutInstruments_1M;FutInstruments_3M;SOFRSwapInstruments]

BootInstruments=12×1 heterogeneous FinInstrument (OISFuture, OvernightIndexedSwap) array with properties:

Name

Create ratecurve Object

Use irbootstrap to create a ratecurve object.

SOFRCurve = irbootstrap(BootInstruments,Settle)

SOFRCurve =

ratecurve with properties:

Type: "zero"

Compounding: -1

Basis: 0

Dates: [12×1 datetime]

Rates: [12×1 double]

Settle: 04-Mar-2021

InterpMethod: "linear"

ShortExtrapMethod: "next"

LongExtrapMethod: "previous"

Create BootInstruments for multiple Deposit, STIRFuture, and Swap instruments and then use irbootstrap to create and display a ratecurve object.

Create Instruments

Use fininstrument to create a Deposit instrument object.

Settle = datetime(2021,6,15); DepRates = [0.0016 0.0017 .00175]'; DepDates = Settle + calmonths([1 2 3]'); Deposits = fininstrument("Deposit","Maturity",DepDates,"Rate",DepRates,'Name',"deposit_instrument")

Deposits=3×1 Deposit array with properties:

Rate

Period

Basis

Maturity

Principal

BusinessDayConvention

Holidays

Name

Use fininstrument to create a STIRFuture instrument object.

FutureRates = [0.002 0.0025 0.0035]'; FutMat = [datetime(2021,9,15) datetime(2021,12,15) datetime(2022,3,16)]'; FutEndDates = [datetime(2021,12,15) datetime(2022,3,15) datetime(2022,6,15)]'; Futures = fininstrument("STIRFuture","Maturity",FutMat,"RateEndDate",FutEndDates,"QuotedPrice",100 - 100*FutureRates,'Name',"stir_future_instrument")

Futures=3×1 STIRFuture array with properties:

QuotedPrice

Basis

RateEndDate

Maturity

Notional

BusinessDayConvention

Holidays

ProjectionCurve

Name

Use fininstrument to create a Swap instrument object.

SwapRates = [.0063 0;.0108 0;.013 0;.015 0;0.017 0;.018 0;0.019 0]; SwapTimes = [2 5 7 10 15 20 30]'; SwapDates = datemnth(Settle,12*SwapTimes); Swaps = fininstrument("Swap","Maturity",SwapDates,"LegRate",SwapRates,'Name',"swap_instrument")

Swaps=7×1 Swap array with properties:

LegRate

LegType

Reset

Basis

Notional

LatestFloatingRate

ResetOffset

DaycountAdjustedCashFlow

ProjectionCurve

BusinessDayConvention

Holidays

EndMonthRule

StartDate

Maturity

Name

Define BootInstruments for the three instruments.

BootInstruments = [Deposits;Futures;Swaps];

Create ratecurve Object Using irbootstrap

Use irbootstrap to create a ratecurve object.

ConvexityAdj = (1:3)'/10000; ZeroCurve = irbootstrap(BootInstruments,Settle,'ConvexityAdjustment',ConvexityAdj,'InterpMethod','pchip')

ZeroCurve =

ratecurve with properties:

Type: "zero"

Compounding: -1

Basis: 0

Dates: [13×1 datetime]

Rates: [13×1 double]

Settle: 15-Jun-2021

InterpMethod: "pchip"

ShortExtrapMethod: "next"

LongExtrapMethod: "previous"

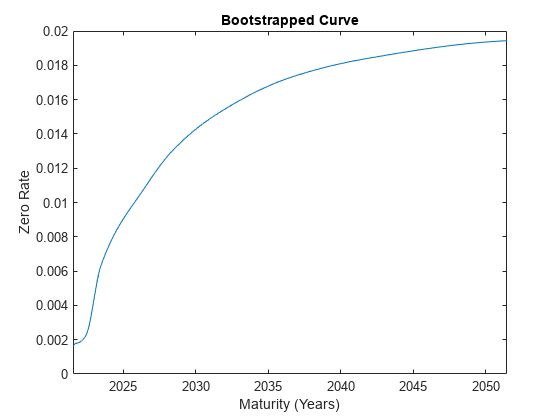

Plot Bootstrapped Curve

PlottingDates = Settle + calmonths(1:360); plot(PlottingDates,zerorates(ZeroCurve,PlottingDates)) xlabel('Maturity (Years)') ylabel('Zero Rate') title('Bootstrapped Curve')

Input Arguments

Collection of instruments, specified as an array of instrument objects. The

collection of instruments can include Deposit, Swap, FRA, STIRFuture, OISFuture, and OvernightIndexedSwap instruments.

Data Types: object

Settlement date, specified as a scalar datetime, string, or date character vector.

To support existing code, irbootstrap also

accepts serial date numbers as inputs, but they are not recommended.

Name-Value Arguments

Specify optional pairs of arguments as

Name1=Value1,...,NameN=ValueN, where Name is

the argument name and Value is the corresponding value.

Name-value arguments must appear after other arguments, but the order of the

pairs does not matter.

Before R2021a, use commas to separate each name and value, and enclose

Name in quotes.

Example: OutCurve =

irbootstrap(Settle,BootInstruments,'Type',"zero",'Compounding',2,'Basis',5,'InterpMethod',"cubic")

Type of interest-rate curve, specified as the comma-separated pair consisting of

'Type' and a scalar string or character vector.

Note

When you use irbootstrap, the value you specify for

Type can impact the curve construction because it affects the

type of data that is interpolated on (that is, forward rates, zero rates, or

discount factors) during the bootstrapping process.

Data Types: char | string

Compounding frequency, specified as the comma-separated pair consisting of

'Compounding' and a scalar numeric using the supported values:

–1, 0, 1,

2, 3, 4,

6, or 12.

Data Types: double

Day-count basis, specified as the comma-separated pair consisting of

'Basis' and a scalar integer.

0 — actual/actual

1 — 30/360 (SIA)

2 — actual/360

3 — actual/365

4 — 30/360 (PSA)

5 — 30/360 (ISDA)

6 — 30/360 (European)

7 — actual/365 (Japanese)

8 — actual/actual (ICMA)

9 — actual/360 (ICMA)

10 — actual/365 (ICMA)

11 — 30/360E (ICMA)

12 — actual/365 (ISDA)

13 — BUS/252

For more information, see Basis.

Data Types: double

Interpolation method, specified as the comma-separated pair consisting of

'InterpMethod' and a scalar string or character vector using a

supported value. For more information on interpolation methods, see interp1.

Data Types: char | string

Extrapolation method for data before first data, specified as the comma-separated

pair consisting of 'ShortExtrapMethod' and a scalar string or

character vector using a supported value. For more information on interpolation

methods, see interp1.

Data Types: char | string

Extrapolation method for data after last data, specified as the comma-separated

pair consisting of 'LongExtrapMethod' and a scalar string or

character vector using a supported value. For more information on interpolation

methods, see interp1.

Data Types: char | string

ratecurve object for discounting cash flows, specified as the

comma-separated pair consisting of 'DiscountCurve' and the name of

a previously created ratecurve object.

Data Types: object

Convexity adjustment for one or more STIRFuture

instruments, specified as the comma-separated pair consisting of

'ConvexityAdjustment' and an

NFutures-by-1 vector of numeric values.

Note

You can only use ConvexityAdjustment when using

irbootstrap with a STIRFuture

instrument. Also, the length of the ConvexityAdjustment vector

must match the number of STIRFuture

instruments.

Data Types: double

Output Arguments

Rate curve, returned as a ratecurve object. The object has the

following properties:

TypeSettleCompoundingBasisDatesRatesInterpMethodShortExtrapMethodLongExtrapMethod

Version History

Introduced in R2020aAlthough irbootstrap supports serial date numbers,

datetime values are recommended instead. The

datetime data type provides flexible date and time

formats, storage out to nanosecond precision, and properties to account for time

zones and daylight saving time.

To convert serial date numbers or text to datetime values, use the datetime function. For example:

t = datetime(738427.656845093,"ConvertFrom","datenum"); y = year(t)

y =

2021

There are no plans to remove support for serial date number inputs.

MATLAB Command

You clicked a link that corresponds to this MATLAB command:

Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands.

웹사이트 선택

번역된 콘텐츠를 보고 지역별 이벤트와 혜택을 살펴보려면 웹사이트를 선택하십시오. 현재 계신 지역에 따라 다음 웹사이트를 권장합니다:

또한 다음 목록에서 웹사이트를 선택하실 수도 있습니다.

사이트 성능 최적화 방법

최고의 사이트 성능을 위해 중국 사이트(중국어 또는 영어)를 선택하십시오. 현재 계신 지역에서는 다른 국가의 MathWorks 사이트 방문이 최적화되지 않았습니다.

미주

- América Latina (Español)

- Canada (English)

- United States (English)

유럽

- Belgium (English)

- Denmark (English)

- Deutschland (Deutsch)

- España (Español)

- Finland (English)

- France (Français)

- Ireland (English)

- Italia (Italiano)

- Luxembourg (English)

- Netherlands (English)

- Norway (English)

- Österreich (Deutsch)

- Portugal (English)

- Sweden (English)

- Switzerland

- United Kingdom (English)