Create saccr Object and Compute Regulatory Values for Multiple Portfolios Containing Multiple Asset Classes

This example shows how to create a saccr object for trades from three portfolios (Portfolios 7, 8, 9), each containing multiple asset classes with a netting set, collateral set, and collateral positions. The trades are:

Portfolio 7

Tr001— Asset class (IR), 10 Year Interest Rate Swap in EURTr002— Asset class (FX), EUR/GBP Forward FX Swap (Trade Decomposition "1b")Tr003— Asset class (CR_SN), Single name CDS on Spain (Short Protection)Tr004— Asset class (CR_IX), CDS iTraxx Europe Crossover Index Receiver OptionTr005— Asset class (EQ_SN), Long Call Option on AAPLTr006— Asset class (EQ_IX), Long Put Option on S&P500 IndexTr007_SOpt— Asset class (CO), Long Put Option on CORN (sold option with premium paid)

Portfolio 7 has one netting set (N001), one collateral set (CSA01), and three collateral positions (ColPos01, ColPos02, ColPos03).

Portfolio 8

Tr008— Asset class (EQ_IX), Long Variance Swap on EURO STOXX 50 (EQUITY_VOL trade)Tr009— Asset class (IR), 10 Year FedFunds / 3M SOFR Basis Swap (USD_BASIS trade)

Portfolio 8 has one netting set (N002), one collateral set (CSA02), and two collateral positions (ColPos04, ColPos05).

Portfolio 9

Tr010— Asset class (CO), Short WTI Crude Futures Put OptionTr011— Asset class (CO), Long Gold Futures Call OptionTr012— Asset class (CO), Long Bitcoin Futures Call Option

Portfolio 9 has one netting set (N003), one collateral set (CSA03), and no collateral positions.

Define Data

Define the foreign exchange (FX) spot currency exchange rate table.

format("default"); Base = ["EUR";"GBP";"GBP"]; Quote = ["USD";"USD";"EUR"]; SpotRate = [1.0543;1.2195;1.1567]; FXSpotTable = table(Base,Quote,SpotRate)

FXSpotTable=3×3 table

Base Quote SpotRate

_____ _____ ________

"EUR" "USD" 1.0543

"GBP" "USD" 1.2195

"GBP" "EUR" 1.1567

Define the SA-CCR CRIF file.

SACCRCRIF = "SACCR_CRIF_Ports_7_8_9.csv";Create saccr Object

Construct the saccr object from SACCRCRIF.

mySACCR = saccr(SACCRCRIF, DomesticCurrency="USD", FXSpot=FXSpotTable)mySACCR =

saccr with properties:

CRIF: [42×19 table]

NumPortfolios: 3

PortfolioIDs: [3×1 string]

CounterpartyIDs: [3×1 string]

Portfolios: [3×1 saccr.Portfolio]

Regulation: "Basel_CRE52"

DomesticCurrency: "USD"

Alpha: [3×1 double]

FXSpotRates: [3×3 table]

TradeDecompositions: [5×2 table]

CollateralHaircuts: [200×6 table]

SupervisoryParameters: [19×7 table]

MaturityBusinessDaysFloor: 10

NumBusinessDaysYear: 250

Display the contents of the SA-CCR CRIF file.

mySACCR.CRIF

ans=42×19 table

PortfolioID TradeID CounterpartyName CounterpartyID NettingSetNumber RiskType Category Qualifier Bucket Label1 Label2 Amount AmountCurrency AmountUSD Regulation Model ValuationDate EndDate Label3

___________ __________ ________________ ______________ ________________ ________ ___________ _____________________________ _________ _________ _________ __________ ______________ __________ ________________ ________ _____________ _______ ______

"Port_007" "ColPos01" <missing> <missing> "N001_CSA01" "COLL" "VM" <missing> <missing> <missing> "CASH" 2e+05 "USD" 2e+05 "Basel (CRE 52)" "SA-CCR" 2023-10-16 NaN NaN

"Port_007" "ColPos02" <missing> <missing> "N001_CSA01" "COLL" "VM" <missing> <missing> <missing> "CASH" 1.5e+05 "EUR" 1.5814e+05 "Basel (CRE 52)" "SA-CCR" 2023-10-16 NaN NaN

"Port_007" "ColPos03" <missing> <missing> "N001_CSA01" "COLL" "IM" "SOVEREIGN" "AAA" <missing> "BOND" 5e+05 "USD" 5e+05 "Basel (CRE 52)" "SA-CCR" 2023-10-16 1.5 NaN

"Port_007" "CSA01" <missing> <missing> "N001_CSA01" "COLL" "DIRECTION" <missing> <missing> "MUTUAL" <missing> NaN <missing> NaN "Basel (CRE 52)" "SA-CCR" 2023-10-16 NaN NaN

"Port_007" "CSA01" <missing> <missing> "N001_CSA01" "COLL" "MPOR" <missing> <missing> "10" <missing> NaN <missing> NaN "Basel (CRE 52)" "SA-CCR" 2023-10-16 NaN NaN

"Port_007" "CSA01" <missing> <missing> "N001_CSA01" "COLL" "MTA" <missing> <missing> <missing> <missing> 0 "USD" 0 "Basel (CRE 52)" "SA-CCR" 2023-10-16 NaN NaN

"Port_007" "CSA01" <missing> <missing> "N001_CSA01" "COLL" "TA" <missing> <missing> <missing> <missing> 0 "USD" 0 "Basel (CRE 52)" "SA-CCR" 2023-10-16 NaN NaN

"Port_007" "Tr001" <missing> <missing> "N001_CSA01" "IR" "EUR" "EUR" <missing> "0" "10" 3.1478e+07 "EUR" 3.3187e+07 "Basel (CRE 52)" "SA-CCR" 2023-10-16 10 1

"Port_007" "Tr001" <missing> <missing> "N001_CSA01" "PV" <missing> <missing> <missing> <missing> <missing> -5650.7 "EUR" -5957.5 "Basel (CRE 52)" "SA-CCR" 2023-10-16 NaN NaN

"Port_007" "Tr002_01" <missing> <missing> "N001_CSA01" "FX" "EURGBP" "EURGBP" <missing> "0.5" "0.5" 1e+06 "EUR" 1.0543e+06 "Basel (CRE 52)" "SA-CCR" 2023-10-16 0.5 -1

"Port_007" "Tr002_02" <missing> <missing> "N001_CSA01" "FX" "EURGBP" "EURGBP" <missing> "0.5" "1" 1e+06 "EUR" 1.0543e+06 "Basel (CRE 52)" "SA-CCR" 2023-10-16 1 1

"Port_007" "Tr002" <missing> <missing> "N001_CSA01" "PV" <missing> <missing> <missing> <missing> <missing> 1702.2 "GBP" 2075.9 "Basel (CRE 52)" "SA-CCR" 2023-10-16 NaN NaN

"Port_007" "Tr003" <missing> <missing> "N001_CSA01" "CR_SN" "CREDIT" "SPAIN" "A" "0" "5" 2.212e+07 "EUR" 2.3321e+07 "Basel (CRE 52)" "SA-CCR" 2023-10-16 5 -1

"Port_007" "Tr003" <missing> <missing> "N001_CSA01" "PV" <missing> <missing> <missing> <missing> <missing> -62783 "EUR" -66192 "Basel (CRE 52)" "SA-CCR" 2023-10-16 NaN NaN

"Port_007" "Tr004" <missing> <missing> "N001_CSA01" "CR_IX" "CREDIT" "CDS iTraxx Europe Crossover" "SG" "0.5" "4.5" 3.5359e+07 "EUR" 3.7279e+07 "Basel (CRE 52)" "SA-CCR" 2023-10-16 4.5 -0.4

"Port_007" "Tr004" <missing> <missing> "N001_CSA01" "PV" <missing> <missing> <missing> <missing> <missing> 5.2464e+05 "EUR" 5.5313e+05 "Basel (CRE 52)" "SA-CCR" 2023-10-16 NaN NaN

⋮

Display Three Portfolios and Trades

Display the number of portfolios and their IDs.

mySACCR.NumPortfolios

ans = 3

mySACCR.PortfolioIDs

ans = 3×1 string

"Port_007"

"Port_008"

"Port_009"

Display the properties of each of the three Portfolio objects (Port_007, Port_008, Port_009).

mySACCR.Portfolios(1)

ans =

Portfolio with properties:

ID: "Port_007"

CounterpartyID: ""

Trades: [7×1 saccr.Trade]

NettingSets: [1×1 saccr.NettingSet]

AssetClasses: [7×1 string]

mySACCR.Portfolios(2)

ans =

Portfolio with properties:

ID: "Port_008"

CounterpartyID: ""

Trades: [2×1 saccr.Trade]

NettingSets: [1×1 saccr.NettingSet]

AssetClasses: [2×1 string]

HedgingSets: [2×1 string]

mySACCR.Portfolios(3)

ans =

Portfolio with properties:

ID: "Port_009"

CounterpartyID: "Exchange"

Trades: [3×1 saccr.Trade]

NettingSets: [1×1 saccr.NettingSet]

AssetClasses: "CO"

HedgingSets: [3×1 string]

Display Trades

Display some of the trades (Tr001, Tr004, Tr007_SOpt) for Portfolio 1 (Port_007).

mySACCR.Portfolios(1).Trades(1)

ans =

Trade with properties:

ID: "Tr001"

NettingSetID: "N001"

CollateralSetID: "CSA01"

AssetClass: "IR"

SubClass: <missing>

HedgingSet: "EUR"

Qualifier: "EUR"

AdjustedNotional: 3.1478e+07

AdjustedNotionalCurrency: "EUR"

AdjustedNotionalUSD: 3.3187e+07

PV: -5.6507e+03

PVCurrency: "EUR"

PVUSD: -5.9575e+03

StartTime: 0

EndTime: 10

MaturityTime: 10

SupervisoryDelta: 1

InputVariant: "1a"

SoldOption: 0

MaturityFactorUncollateralized: 1

MaturityFactorCollateralized: 0.3000

MaturityBucket: "B3: > 5Y"

mySACCR.Portfolios(1).Trades(4)

ans =

Trade with properties:

ID: "Tr004"

NettingSetID: "N001"

CollateralSetID: "CSA01"

AssetClass: "CR_IX"

SubClass: "SG"

HedgingSet: "CREDIT"

Qualifier: "CDS iTraxx Europe Crossover"

AdjustedNotional: 3.5359e+07

AdjustedNotionalCurrency: "EUR"

AdjustedNotionalUSD: 3.7279e+07

PV: 5.2464e+05

PVCurrency: "EUR"

PVUSD: 5.5313e+05

StartTime: 0.5000

EndTime: 4.5000

MaturityTime: 4.5000

SupervisoryDelta: -0.4000

InputVariant: "1a"

SoldOption: 0

MaturityFactorUncollateralized: 1

MaturityFactorCollateralized: 0.3000

MaturityBucket: [0×1 string]

mySACCR.Portfolios(1).Trades(7)

ans =

Trade with properties:

ID: "Tr007_SOpt"

NettingSetID: "N001"

CollateralSetID: "CSA01"

AssetClass: "CO"

SubClass: "AGRICULTURAL"

HedgingSet: "AGRI"

Qualifier: "CORN"

AdjustedNotional: 1.0435e+05

AdjustedNotionalCurrency: "USD"

AdjustedNotionalUSD: 1.0435e+05

PV: -9.7215e+03

PVCurrency: "USD"

PVUSD: -9.7215e+03

StartTime: 0

EndTime: 0.5000

MaturityTime: 0.5000

SupervisoryDelta: -0.3600

InputVariant: "1a"

SoldOption: 1

MaturityFactorUncollateralized: 0.7071

MaturityFactorCollateralized: 0.3000

MaturityBucket: [0×1 string]

Display trades (Tr008, Tr009) for Portfolio 2 (Port_008).

mySACCR.Portfolios(2).Trades(1)

ans =

Trade with properties:

ID: "Tr008"

NettingSetID: "N002"

CollateralSetID: "CSA02"

AssetClass: "EQ_IX"

SubClass: <missing>

HedgingSet: "EQUITY_VOL"

Qualifier: "STOXX50.VOL"

AdjustedNotional: 1000000

AdjustedNotionalCurrency: "EUR"

AdjustedNotionalUSD: 1054300

PV: 2.7244e+05

PVCurrency: "EUR"

PVUSD: 2.8723e+05

StartTime: 0

EndTime: 5

MaturityTime: 5

SupervisoryDelta: 1

InputVariant: "1a"

SoldOption: 0

MaturityFactorUncollateralized: 1

MaturityFactorCollateralized: 0.4243

MaturityBucket: [0×1 string]

mySACCR.Portfolios(2).Trades(2)

ans =

Trade with properties:

ID: "Tr009"

NettingSetID: "N002"

CollateralSetID: "CSA02"

AssetClass: "IR"

SubClass: <missing>

HedgingSet: "USD_BASIS"

Qualifier: "FedFunds_3MSOFR"

AdjustedNotional: 7.8694e+07

AdjustedNotionalCurrency: "USD"

AdjustedNotionalUSD: 7.8694e+07

PV: 8.9342e+05

PVCurrency: "USD"

PVUSD: 8.9342e+05

StartTime: 0

EndTime: 10

MaturityTime: 10

SupervisoryDelta: -1

InputVariant: "1a"

SoldOption: 0

MaturityFactorUncollateralized: 1

MaturityFactorCollateralized: 0.4243

MaturityBucket: "B3: > 5Y"

Display trades (Tr010, Tr011, Tr012) for Portfolio 3 (Port_009).

mySACCR.Portfolios(3).Trades(1)

ans =

Trade with properties:

ID: "Tr010"

NettingSetID: "N003"

CollateralSetID: "CA03"

AssetClass: "CO"

SubClass: "OIL/GAS"

HedgingSet: "ENERGY"

Qualifier: "WTI"

AdjustedNotional: 2000000

AdjustedNotionalCurrency: "USD"

AdjustedNotionalUSD: 2000000

PV: 0

PVCurrency: "USD"

PVUSD: 0

StartTime: 0

EndTime: 0.7500

MaturityTime: 0.7500

SupervisoryDelta: 0.6100

InputVariant: "1a"

SoldOption: 0

MaturityFactorUncollateralized: 0.8660

MaturityFactorCollateralized: 0.3000

MaturityBucket: [0×1 string]

mySACCR.Portfolios(3).Trades(2)

ans =

Trade with properties:

ID: "Tr011"

NettingSetID: "N003"

CollateralSetID: "CA03"

AssetClass: "CO"

SubClass: "METALS"

HedgingSet: "METALS"

Qualifier: "XAU"

AdjustedNotional: 3.3526e+05

AdjustedNotionalCurrency: "USD"

AdjustedNotionalUSD: 3.3526e+05

PV: 0

PVCurrency: "USD"

PVUSD: 0

StartTime: 0

EndTime: 0.5000

MaturityTime: 0.5000

SupervisoryDelta: 0.4200

InputVariant: "1a"

SoldOption: 0

MaturityFactorUncollateralized: 0.7071

MaturityFactorCollateralized: 0.3000

MaturityBucket: [0×1 string]

mySACCR.Portfolios(3).Trades(3)

ans =

Trade with properties:

ID: "Tr012"

NettingSetID: "N003"

CollateralSetID: "CA03"

AssetClass: "CO"

SubClass: "OTHER"

HedgingSet: "OTHER"

Qualifier: "BITCOIN"

AdjustedNotional: 1.4791e+05

AdjustedNotionalCurrency: "USD"

AdjustedNotionalUSD: 1.4791e+05

PV: 0

PVCurrency: "USD"

PVUSD: 0

StartTime: 0

EndTime: 0.7500

MaturityTime: 0.7500

SupervisoryDelta: 0.5800

InputVariant: "1a"

SoldOption: 0

MaturityFactorUncollateralized: 0.8660

MaturityFactorCollateralized: 0.3000

MaturityBucket: [0×1 string]

Display Netting Sets for Three Portfolios

Display the NettingSet object (N001) for Portfolio 1 (Port_007).

mySACCR.Portfolios(1).NettingSets

ans =

NettingSet with properties:

ID: "N001"

CollateralSets: [1×1 saccr.CollateralSet]

Display the NettingSet object (N002) for Portfolio 2 (Port_008).

mySACCR.Portfolios(2).NettingSets

ans =

NettingSet with properties:

ID: "N002"

CollateralSets: [1×1 saccr.CollateralSet]

Display the NettingSet object (N003) for Portfolio 3 (Port_009).

mySACCR.Portfolios(3).NettingSets

ans =

NettingSet with properties:

ID: "N003"

CollateralSets: [1×1 saccr.CollateralSet]

Display Collateral Sets for Three Portfolios

Display details for the CollateralSet object (CSA01) for Portfolio 1 (Port_007).

mySACCR.Portfolios(1).NettingSets.CollateralSets

ans =

CollateralSet with properties:

ID: "CSA01"

NettingSetID: "N001"

Direction: "MUTUAL"

Threshold: 0

ThresholdCurrency: "USD"

MTA: 0

MTACurrency: "USD"

MPOR: 10

STM: 0

CollateralPositions: [3×1 saccr.CollateralPosition]

Display details for the CollateralSet object (CSA02) for Portfolio 2 (Port_008).

mySACCR.Portfolios(2).NettingSets.CollateralSets

ans =

CollateralSet with properties:

ID: "CSA02"

NettingSetID: "N002"

Direction: "MUTUAL"

Threshold: 1000000

ThresholdCurrency: "USD"

MTA: 100000

MTACurrency: "USD"

MPOR: 20

STM: 0

CollateralPositions: [2×1 saccr.CollateralPosition]

Display details for the CollateralSet object (CSA03) for Portfolio 3 (Port_009).

mySACCR.Portfolios(3).NettingSets.CollateralSets

ans =

CollateralSet with properties:

ID: "CA03"

NettingSetID: "N003"

Direction: "MUTUAL"

Threshold: 500000

ThresholdCurrency: "USD"

MTA: 50000

MTACurrency: "USD"

MPOR: 10

STM: 0

CollateralPositions: [0×1 saccr.CollateralPosition]

Display Collaterl Positions for Three Portfolios

Display the CollateralPosition objects (ColPos01, ColPos02, ColPos03) for Portfolio 1 (Port_007).

mySACCR.Portfolios(1).NettingSets.CollateralSets.CollateralPositions(1)

ans =

CollateralPosition with properties:

ID: "ColPos01"

NettingSetID: "N001"

CollateralSetID: "CSA01"

MarginType: "VM"

Currency: "USD"

Notional: 200000

NotionalUSD: 200000

MaturityTime: NaN

Segregated: 0

Rating: <missing>

AssetType: "CASH"

SubType: <missing>

ResidualMaturity: [0×0 string]

mySACCR.Portfolios(1).NettingSets.CollateralSets.CollateralPositions(2)

ans =

CollateralPosition with properties:

ID: "ColPos02"

NettingSetID: "N001"

CollateralSetID: "CSA01"

MarginType: "VM"

Currency: "EUR"

Notional: 150000

NotionalUSD: 158145

MaturityTime: NaN

Segregated: 0

Rating: <missing>

AssetType: "CASH"

SubType: <missing>

ResidualMaturity: [0×0 string]

mySACCR.Portfolios(1).NettingSets.CollateralSets.CollateralPositions(3)

ans =

CollateralPosition with properties:

ID: "ColPos03"

NettingSetID: "N001"

CollateralSetID: "CSA01"

MarginType: "IM"

Currency: "USD"

Notional: 500000

NotionalUSD: 500000

MaturityTime: 1.5000

Segregated: 0

Rating: "AAA"

AssetType: "BOND"

SubType: "SOVEREIGN"

ResidualMaturity: "> 1Y, <= 3Y"

Display the CollateralPosition objects (ColPos04, ColPos05) for Portfolio 2 (Port_008).

mySACCR.Portfolios(2).NettingSets.CollateralSets.CollateralPositions(1)

ans =

CollateralPosition with properties:

ID: "ColPos04"

NettingSetID: "N002"

CollateralSetID: "CSA02"

MarginType: "VM"

Currency: "USD"

Notional: 100000

NotionalUSD: 10000

MaturityTime: NaN

Segregated: 0

Rating: <missing>

AssetType: "EQUITY"

SubType: "MAININDEX"

ResidualMaturity: [0×0 string]

mySACCR.Portfolios(2).NettingSets.CollateralSets.CollateralPositions(2)

ans =

CollateralPosition with properties:

ID: "ColPos05"

NettingSetID: "N002"

CollateralSetID: "CSA02"

MarginType: "IM"

Currency: "USD"

Notional: 250000

NotionalUSD: 25000

MaturityTime: NaN

Segregated: 0

Rating: <missing>

AssetType: "GOLD"

SubType: <missing>

ResidualMaturity: [0×0 string]

Compute Replacement Cost

Compute replacement cost (RC) component results using rc.

RCResults = rc(mySACCR)

RCResults =

RCResults with properties:

NumPortfolios: 3

PortfolioIDs: [3×1 string]

CounterpartyIDs: [3×1 string]

Regulation: "Basel_CRE52"

DomesticCurrency: "USD"

RCUncollateralized: [3×1 double]

RCCollateralized: [3×1 double]

RCResults.RCUncollateralized

ans = 3×1

106 ×

0.2397

1.1806

0

RCResults.RCCollateralized

ans = 3×1

106 ×

0

1.1555

0.5500

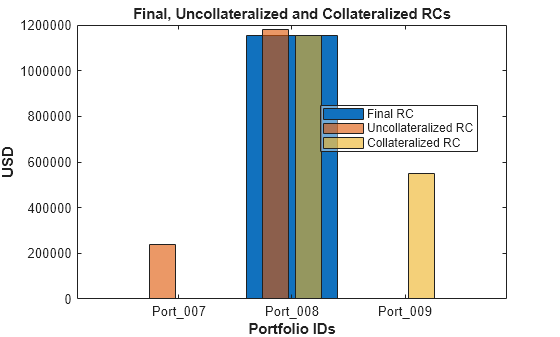

Create a bar chart of portfolio RC values using rcChart.

rcChart(mySACCR,Style="comparison") ax = gca; ax.YAxis.Exponent = 0; ytickformat('%.0f')

Compute Add-On Component

Compute add-on component results using addOn.

AddOnResults = addOn(mySACCR)

AddOnResults =

AddOnResults with properties:

NumPortfolios: 3

PortfolioIDs: [3×1 string]

CounterpartyIDs: [3×1 string]

Regulation: "Basel_CRE52"

DomesticCurrency: "USD"

AddOnAggregateUncollateralized: [3×1 double]

AddOnAggregateCollateralized: [3×1 double]

AddOnAssetClassesUncollateralized: [1×1 saccr.AddOnAssetClassResults]

AddOnAssetClassesCollateralized: [1×1 saccr.AddOnAssetClassResults]

AddOnResults.AddOnAggregateUncollateralized

ans = 3×1

106 ×

1.1177

1.2510

0.2215

AddOnResults.AddOnAggregateCollateralized

ans = 3×1

105 ×

3.3218

5.3077

0.7812

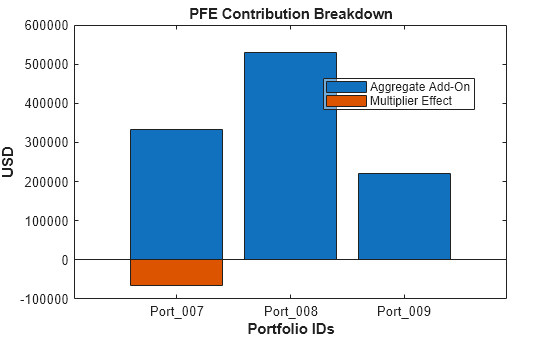

Create a bar chart of portfolio add-on values using addOnChart.

addOnChart(mySACCR,Style="breakdown") ax = gca; ax.YAxis.Exponent = 0; ytickformat('%.0f')

Compute PFE

Compute potential future exposure (PFE) component results using pfe.

PFEResults = pfe(mySACCR)

PFEResults =

PFEResults with properties:

NumPortfolios: 3

PortfolioIDs: [3×1 string]

CounterpartyIDs: [3×1 string]

Regulation: "Basel_CRE52"

DomesticCurrency: "USD"

PFEUncollateralized: [3×1 double]

PFECollateralized: [3×1 double]

MultiplierUncollateralized: [3×1 double]

MultiplierCollateralized: [3×1 double]

AddOnResults: [1×1 saccr.AddOnResults]

PFEResults.PFEUncollateralized

ans = 3×1

106 ×

1.1177

1.2510

0.2215

PFEResults.PFECollateralized

ans = 3×1

105 ×

2.6710

5.3077

0.7812

Create a bar chart of portfolio PFE values using pfeChart.

pfeChart(mySACCR,Style="breakdown") ax = gca; ax.YAxis.Exponent = 0; ytickformat('%.0f')

Compute EAD and Display Results

Compute exposure at default (EAD) results using ead and show the results table.

EADResults = ead(mySACCR)

EADResults =

EADResults with properties:

NumPortfolios: 3

PortfolioIDs: [3×1 string]

CounterpartyIDs: [3×1 string]

Regulation: "Basel_CRE52"

DomesticCurrency: "USD"

EAD: [3×1 double]

Alpha: [3×1 double]

RC: [3×1 double]

PFE: [3×1 double]

Multiplier: [3×1 double]

AddOnAggregate: [3×1 double]

RCResults: [1×1 saccr.RCResults]

PFEResults: [1×1 saccr.PFEResults]

ResultsTable: [3×17 table]

EADResults.ResultsTable

ans=3×17 table

PortfolioIDs CounterpartyIDs Regulation DomesticCurrency EAD Alpha RC PFE Multiplier AddOnAggregate AddOnIR AddOnFX AddOnCR AddOnEQ AddOnCO Collateralized UsedCollateral

____________ _______________ _____________ ________________ __________ _____ __________ __________ __________ ______________ _______ _______ _______ __________ __________ ______________ ______________

"Port_007" "" "Basel_CRE52" "USD" 3.7394e+05 1.4 0 2.671e+05 0.80408 3.3218e+05 49780 0 65013 2.1536e+05 2028.6 true true

"Port_008" "" "Basel_CRE52" "USD" 2.3608e+06 1.4 1.1555e+06 5.3077e+05 1 5.3077e+05 83467 0 0 4.473e+05 0 true true

"Port_009" "Exchange" "Basel_CRE52" "USD" 3.1006e+05 1.4 0 2.2147e+05 1 2.2147e+05 0 0 0 0 2.2147e+05 true false

Create a bar chart of portfolio EAD values using eadChart.

eadChart(mySACCR,Style="breakdown") ax = gca; ax.YAxis.Exponent = 0; ytickformat('%.0f')

Aggregate EAD Results by Counterparty

Aggregate EAD results using aggregateByCounterparty.

aggregateByCounterparty(EADResults)

ans=2×2 table

CounterpartyID CounterpartyEAD

______________ _______________

"" 2.7348e+06

"Exchange" 3.1006e+05

Aggregate Total EAD Results

Aggregate total EAD using aggregate.

aggregate(EADResults)

ans = 3.0449e+06

See Also

rc | addOn | pfe | ead | addOnChart | eadChart | pfeChart | rcChart | frtbsa

Topics

- Framework for Standardized Approach to Calculating Counterparty Credit Risk: Introduction

- Create saccr Object and Compute Regulatory Values for Interest-Rate Swap

- Create saccr Object and Compute Regulatory Values for Forward FX Swap

- Create saccr Object and Compute Regulatory Values for Two CDS Trades

- Create saccr Object and Compute Regulatory Values for Multiple Asset Classes

- Create saccr Object and Compute Regulatory Values for Multiple Asset Classes with Netting Set

- Create saccr Object and Compute Regulatory Values for Multiple Asset Classes with Netting Set and Collateral Set

- Create saccr Object and Compute Regulatory Values for Multiple Asset Classes with Netting Set, Collateral Set, and Collateral Positions

- SA-CCR Transactional Elements

- ISDA SA-CCR CRIF File Specifications