Hedge Using Monte Carlo Simulation

This example shows how to use Monte Carlo simulation to model the probability of different outcomes in a process that cannot easily be predicted due to the intervention of random variables.

Define Stock Profile

Assume the following specification for a stock.

% Price at time 0 Price_0 = 200; % Drift (annualized) Drift = 0.08; % Volatility (annualized) Vol = 0.4; % Valuation date Valuation = '01-Jan-2012'; % Investment horizon date Horizon = '01-Jan-2013'; % Risk free rate RiskFreeRate = 0.03;

Use Monte Carlo Simulation

Simulate this stock's price movements from the valuation date to the Horizon date.

% Number of trials for the Monte Carlo simulation NTRIALS = 100000; % Length (in years) of the simulation T = date2time(Valuation,Horizon,1,1); % Number of periods per trial. Approximately 100 periods per year. NPERIODS = round(100*T); % Length (in years) of each time step per period dt = T/NPERIODS; % Instantiate the GBM object StockGBM = gbm(Drift,Vol,'StartState',Price_0); % Run the simulation Paths = StockGBM.simByEuler(NPERIODS,'NTRIALS',NTRIALS, ... 'DeltaTime',dt,'Antithetic',true);

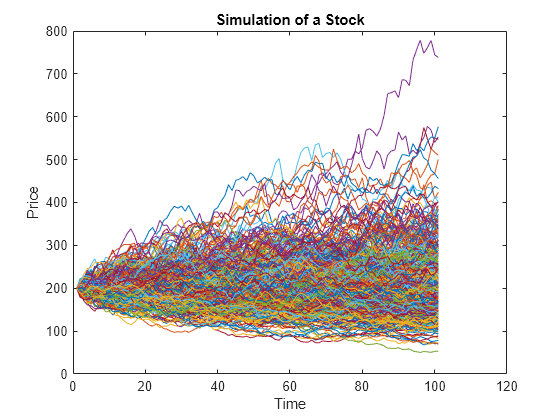

Plot Stock Simulation

For efficiency, only plot some scenarios.

plot(squeeze(Paths(:,:,1:500))); title('Simulation of a Stock'); xlabel('Time'); ylabel('Price');

Calculate Put Option for Stock Using Black-Scholes

Use blsprice to calculate the put option.

Strike = 190; [~,Put] = blsprice(Price_0,Strike,RiskFreeRate,T,Vol);

Generate Simulation Matrix

The simulation uses two strategies: (1) stock only and (2) stock with put cover.

AssetScenarios = zeros(NTRIALS,2);

Price_T = squeeze(Paths(end,1,:));

% Strategy 1: Stock only

AssetScenarios(:,1) = (Price_T - Price_0) ./ Price_0AssetScenarios = 100000×2

0.5927 0

-0.4069 0

-0.2526 0

0.3365 0

-0.3606 0

0.5549 0

-0.2211 0

0.3080 0

0.0849 0

-0.0416 0

0.1977 0

-0.1537 0

-0.1338 0

0.1681 0

-0.3236 0

⋮

% Strategy 2: Stock with put option cover AssetScenarios(:, 2) = (max(Price_T, Strike) - (Price_0 + Put)) ./ ... (Price_0 + Put)

AssetScenarios = 100000×2

0.5927 0.4266

-0.4069 -0.1490

-0.2526 -0.1490

0.3365 0.1972

-0.3606 -0.1490

0.5549 0.3928

-0.2211 -0.1490

0.3080 0.1716

0.0849 -0.0282

-0.0416 -0.1415

0.1977 0.0728

-0.1537 -0.1490

-0.1338 -0.1490

0.1681 0.0463

-0.3236 -0.1490

⋮

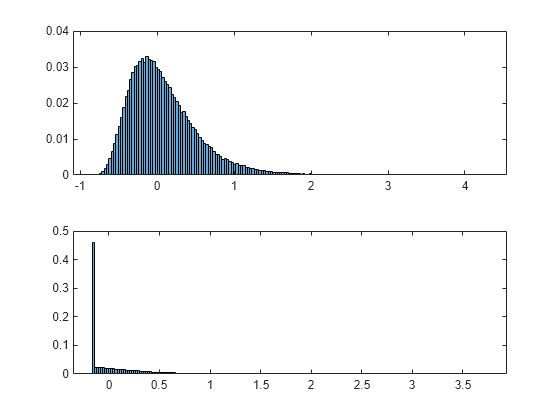

Plot Distributions

The returns for the two strategies are not normally distributed.

% Create histogram figure; subplot(2,1,1); histogram(AssetScenarios(:,1),'Normalization','probability') subplot(2,1,2); histogram(AssetScenarios(:,2),'Normalization','probability')

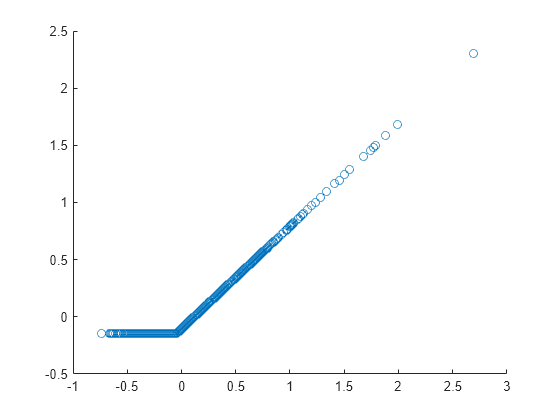

% Create scatter plot of the two strategies. Notice that the two strategies are highly % correlated. figure; scatter(AssetScenarios(1:1000,1),AssetScenarios(1:1000,2));

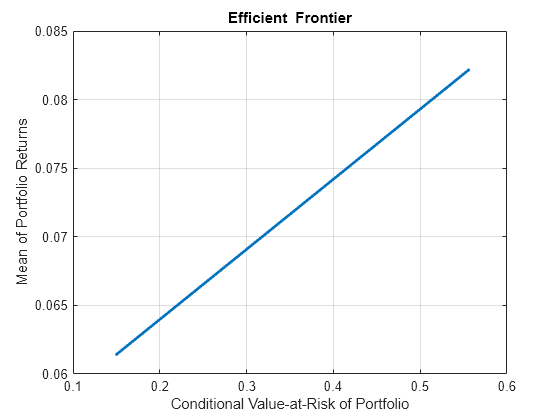

Create PortfolioCVaR Object to Obtain Portfolio Weights

Create a PortfolioCVaR object.

p = PortfolioCVaR('Scenarios',AssetScenarios,'LowerBound',0, ... 'Budget',1,'ProbabilityLevel',0.95)

p =

PortfolioCVaR with properties:

BuyCost: []

SellCost: []

RiskFreeRate: []

ProbabilityLevel: 0.9500

Turnover: []

BuyTurnover: []

SellTurnover: []

NumScenarios: 100000

Name: []

NumAssets: 2

AssetList: []

InitPort: []

AInequality: []

bInequality: []

AEquality: []

bEquality: []

LowerBound: [2×1 double]

UpperBound: []

LowerBudget: 1

UpperBudget: 1

GroupMatrix: []

LowerGroup: []

UpperGroup: []

GroupA: []

GroupB: []

LowerRatio: []

UpperRatio: []

MinNumAssets: []

MaxNumAssets: []

ConditionalBudgetThreshold: []

ConditionalUpperBudget: []

BoundType: []

% Estimate the efficient frontier to obtain portfolio weights. pwgt = estimateFrontier(p); % Plot the efficient frontier. figure; plotFrontier(p,pwgt);

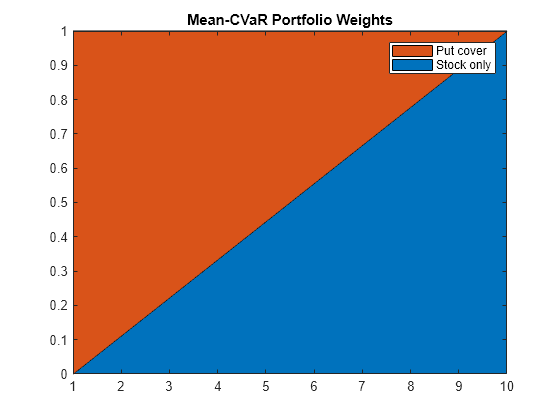

% Plot the portfolio weights. figure; area(pwgt'); axis([1 10 0 1]) legend('Stock only','Put cover'); title('Mean-CVaR Portfolio Weights');

Add Hedging Strategies

Use blsprice to calculate prices of put options with different strikes.

% Put option with strike at 50% of current underlying price Strike50 = 0.50*Price_0; [~, Put50] = blsprice(Price_0,Strike50,RiskFreeRate,T,Vol); % Put option with strike at 75% of current underlying price Strike75 = 0.75*Price_0; [~, Put75] = blsprice(Price_0,Strike75,RiskFreeRate,T,Vol); % Put option with strike at 90% of current underlying price Strike90 = 0.90*Price_0; [~, Put90] = blsprice(Price_0,Strike90,RiskFreeRate,T,Vol); % Put option with strike at 95% of current underlying price Strike95 = 0.95*Price_0; % Same as strike [~, Put95] = blsprice(Price_0,Strike95,RiskFreeRate,T,Vol);

Generate Simulation Matrix for Strategies

Generate simulation matrix for the strategy variations.

AssetScenarios = zeros(NTRIALS, 5); % Strategy 1: Stock only AssetScenarios(:, 1) = (Price_T - Price_0) ./ Price_0; % Strategy 2: Put option cover at 50% AssetScenarios(:, 2) = (max(Price_T, Strike50) - (Price_0 + Put50)) ./ ... (Price_0 + Put50); % Strategy 2: Put option cover at 75% AssetScenarios(:, 3) = (max(Price_T, Strike75) - (Price_0 + Put75)) ./ ... (Price_0 + Put75); % Strategy 2: Put option cover at 90% AssetScenarios(:, 4) = (max(Price_T, Strike90) - (Price_0 + Put90)) ./ ... (Price_0 + Put90); % Strategy 2: Put option cover at 95% AssetScenarios(:, 5) = (max(Price_T, Strike95) - (Price_0 + Put95)) ./ ... (Price_0 + Put95);

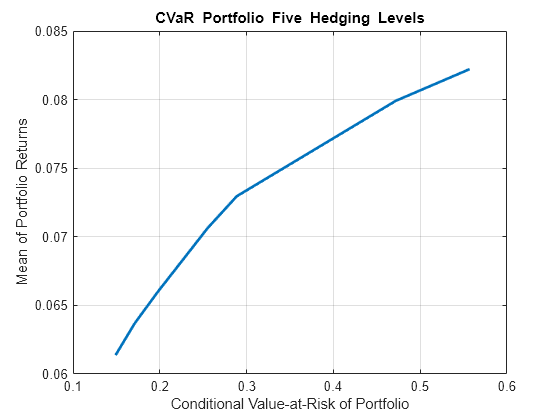

Create PortfolioCVar Object Using Hedging Strategies

Create a PortfolioCVaR object using the hedging strategies.

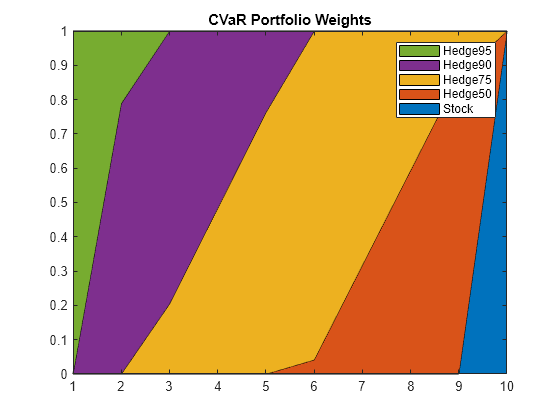

p = PortfolioCVaR('Name','CVaR Portfolio Five Hedging Levels', ... 'AssetList',{'Stock','Hedge50','Hedge75','Hedge90','Hedge95'}, ... 'Scenarios',AssetScenarios,'LowerBound',0, ... 'Budget',1,'ProbabilityLevel',0.95); % Estimate the efficient frontier to obtain portfolio weights. pwgt = estimateFrontier(p); % Plot the efficient frontier. figure; plotFrontier(p,pwgt);

% Plot the portfolio weights. figure; area(pwgt'); legend(p.AssetList); axis([1 10 0 1]) title('CVaR Portfolio Weights');

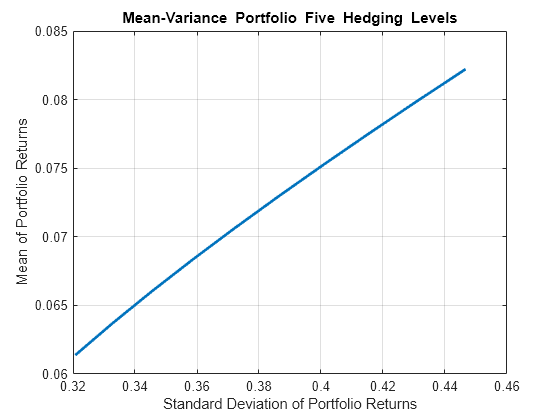

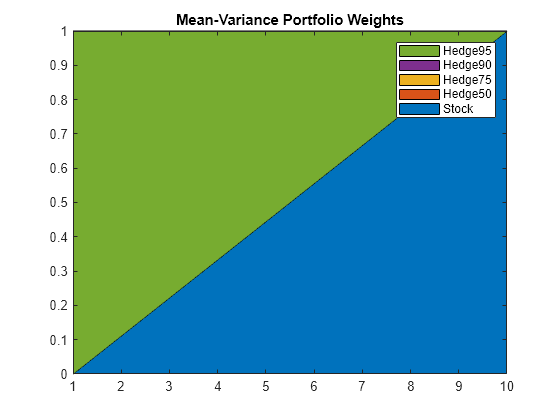

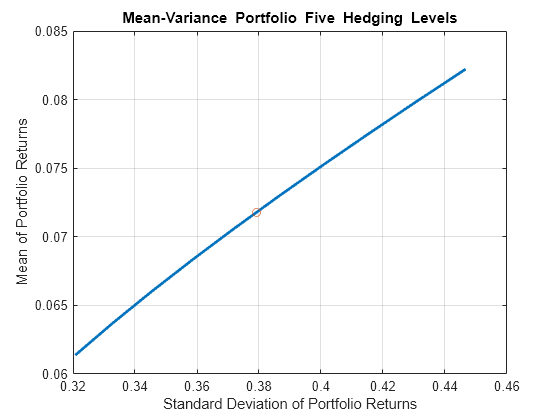

Create Mean-Variance Portfolio

Create a Portfolio object to compare with the PortfolioCVaR object.

% Create the Portfolio object. pmv = Portfolio('Name','Mean-Variance Portfolio Five Hedging Levels', ... 'AssetList',{'Stock','Hedge50','Hedge75','Hedge90','Hedge95'}); pmv = pmv.estimateAssetMoments(p.getScenarios); pmv = pmv.setDefaultConstraints; % Estimate the efficient frontier to obtain portfolio weights. pwgtmv = pmv.estimateFrontier; % Plot the efficient frontier. figure; mvFrontierHandle = pmv.plotFrontier(pwgtmv);

% Plot the portfolio weights. figure; area(pwgtmv'); legend(pmv.AssetList); axis([1 10 0 1]) title('Mean-Variance Portfolio Weights');

Plot Target Portfolio on Mean Variance Frontier

Determine the achievable levels of return.

% Achievable levels of return pretlimits = pmv.estimatePortReturn(pmv.estimateFrontierLimits); TargetRet = mean(pretlimits); % Target half way up the frontier % Obtain risk level at target return pwgtmvTarget = pmv.estimateFrontierByReturn(TargetRet); priskTarget = pmv.estimatePortRisk(pwgtmvTarget); % Plot point onto mean variance frontier figure; pmv.plotFrontier(pwgtmv); hold on scatter(priskTarget,TargetRet); hold off

Plot Mean Variance Efficient Portfolio on CVaR Frontier

The following plot displays that the target portfolio is below the mean-CVaR efficient frontier.

% Obtain CVaR risk for mean variance target return portfolio pretTargetCVaR = p.estimatePortReturn(pwgtmvTarget); % Should be TargetRet priskTargetCVaR = p.estimatePortRisk(pwgtmvTarget); % Risk proxy is CVaR % Plot target return portfolio onto mean-CVaR frontier figure; p.plotFrontier(pwgt); hold on scatter(priskTargetCVaR,pretTargetCVaR); hold off

See Also

Topics

- Using Extreme Value Theory and Copulas to Evaluate Market Risk (Econometrics Toolbox)